Alpha in the Apocalypse: Deckers +20% While Silver Crashes 16%

While the "Safe Haven" trap liquidates nearly $4 trillion in wealth in minutes, our uncorrelated value fortresses—DECK, CMCSA, UPS and TGT ascend.

“A top hedge fund manager with top results in the world” - lead SEC prosecutor during Fr. Lemelson’s 10-year unlawful prosecution.

The current market environment operates as a theater of the absurd, a sprawling hall of mirrors where the speculative crowd pursues digital phantoms while the bedrock of reality, actual intrinsic value, is neglected by the institutional consensus. While professional allocators were occupied with eulogizing the consumer, our research remained anchored in the foundational principle of the Margin of Safety.

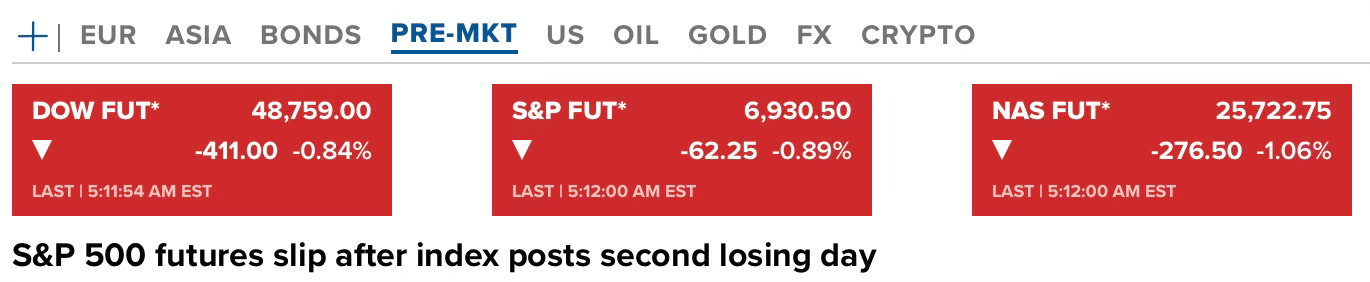

Yesterday’s after-hours trade provided a definitive catalyst for the consensus, as Deckers Outdoor Corporation (DECK) erupted with a dramatic 20% gain following a record-shattering earnings release. This surge is particularly significant given the broader market’s retreat; the S&P 500 and Nasdaq ended Thursday in negative territory, and pre-market futures for Friday, January 30, indicate continued selling pressure as large-cap technology constituents falter. This represents a quintessence of uncorrelated outperformance, generating alpha while the benchmark indices erode.

The central issue is not merely that the market displays profound structural inefficiencies, it does. The imperative question is: why is the institutional consensus so frequently aligned with the entities that failed to anticipate this secular transition?

The HOKA Prophecy: A $1.96 Billion Indictment of the Naysayers

Deckers (owner of HOKA) trades at just 14.9 (we have a substantial commitment in DECK). The market is pricing Nike like a high-growth tech stock, while the arithmetic shows a shrinking utility. - Nike’s $12 Billion Illusion: Why a “Beat” Triggered a Crash (December 19, 2025)

On December 19, we observed that Deckers (DECK) was a rare enterprise being appraised without regard for its durable competitive advantages. The analysis suggested that while Nike was occupied with the “$12 Billion Illusion” of growth, Deckers was fortifying an economic moat comprised of brand equity and rigorous operational discipline, while trading at a pittance.

Yesterday, the empirical data emerged with clarity:

Record Revenue: $1.96 billion in a single quarter, a 7% surge that skeptics characterized as improbable in this macroeconomic climate.

Earnings Expansion: Diluted EPS of $3.33, an 11% year-over-year increase.

Guidance Elevation: Management revised the FY2026 revenue outlook to $5.425 billion, underpinned by sustained double-digit momentum in the HOKA segment.

The 20% Alpha Spike: DECK shares surged in the after-hours session, a direct consequence of the market finally reconciling with the record-breaking profitability it had previously discounted even as the S&P 500 declined during regular hours and futures continued their descent overnight.

This was not a mere “beat”. It was a validation of rigorous security analysis. While the broader indices languished, DECK decoupled. This distinguishes the speculator, who relies on the “mood” of the crowd, from the investor, who anchors their capital in the quantitative reality of a 59.8% gross margin.

The $3 Trillion “Bezzle”: The Collapse of the Unproductive Asset Trap

How can a market function when every physical ounce of silver is currently backing more than 20 ounces of “paper promises”? - The $5,500 Gold Trap: Why the “Safe Haven” is the Ultimate Bezzle (January 30, 2026)

Less than 24 hours later:

While Deckers provided the harvest of discipline, the “Safe Haven” crowded trade resulted in a severe capital impairment for speculators. Only yesterday, we identified the $5,500 Gold target as a “bezzle,” a psychological trap for those seeking refuge in unproductive assets.

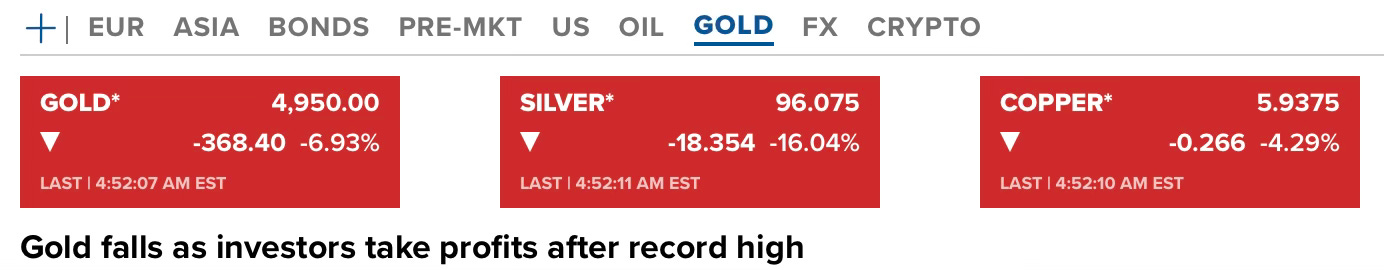

The market’s reaction was immediate and decisive. In early trading today, January 30, global gold prices have entered a sharp correction, retreating toward the $4,900 level (dropping nearly 7%). Silver has experienced even greater volatility, declining toward $96 per ounce (dropping over 16% in early trade) after failing to sustain its recent highs.

Almost $4 trillion in value was wiped out from gold and silver in a matter of minutes, proving that true refuge is found in cash-flow-generative enterprises rather than the false security of non-yielding commodities.

A Consistent Pattern of Alpha: TGT, UPS, CMCSA, and DECK

The outperformance of Deckers is not an isolated occurrence, but part of a systematic pattern of identifying mispriced securities. Our investment ideas have consistently exhibited uncorrelated returns relative to the S&P 500:

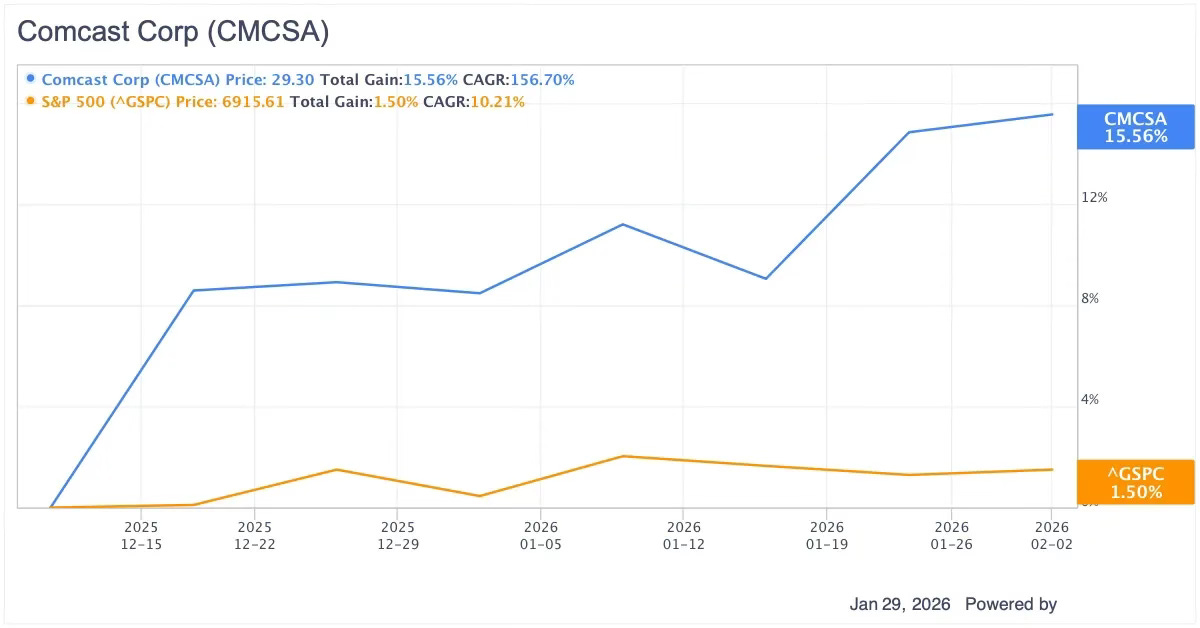

Comcast (CMCSA): Identified for its intrinsic value on December 11, 2025. It surged yesterday following an EPS beat, acting as a defensive bulwark while the broader market sank.

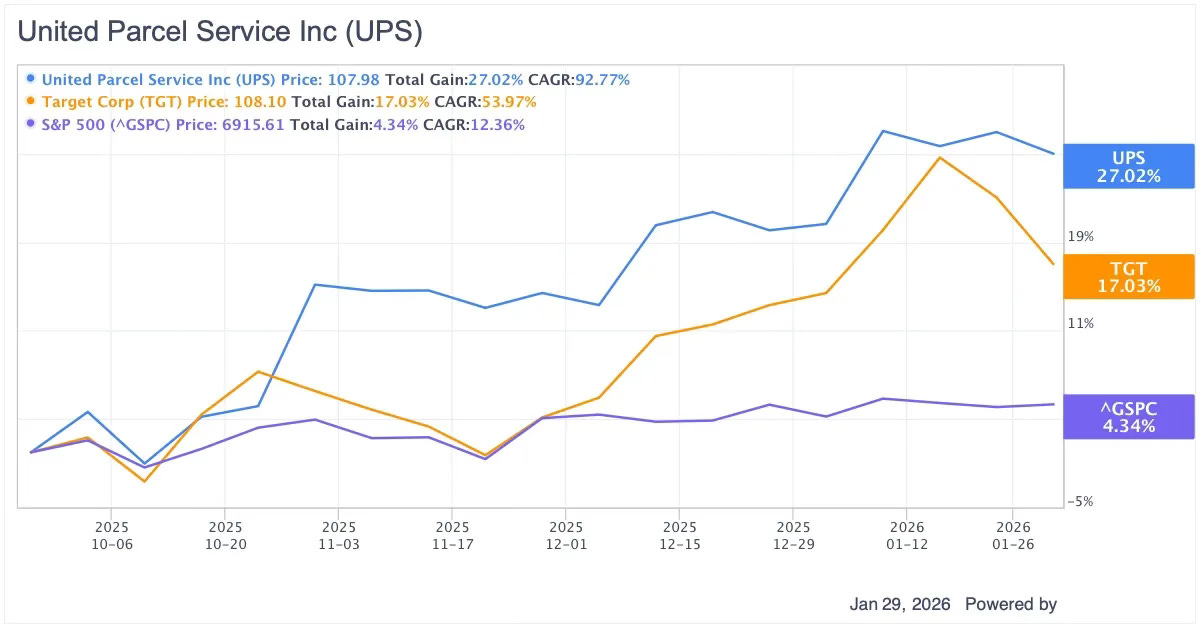

UPS & Target (TGT): Published on September 25, 2025. Both company’s have signficiantly outperformed, maintaining an upward trajectory even as the Nasdaq Composite and S&P 500 benchmarks faced significant headwinds.

Deckers (DECK): Now established as another driver of portfolio alpha, has significantly outperformed the benchmark since its December 19 publication, culminating in yesterday’s ~20% move in after hours trading. The Deckers investment idea has returned 18.31% vs. the S&P 500’s 2.60% since publication.

This data confirms that a disciplined adherence to price-value dislocations, economic moats and capital allocation yields leads to results that are fundamentally decoupled from the indices.

The Authority of Discipline: The Cost of Missing the Next Call

We are currently navigating a “Technocratic Oligarchy” where the truth is the first casualty of the corporate war machine. The government and “Big Pharma” tried to silence me for more than a decade because the work reveals the gears of the system turning before they even begin to grind.

My convictions are not merely academic. They are forged in the fire of a 10+ year battle against an unlawful prosecution that sought to bury the truth. I stood my ground then, and I stand my ground now. Even Marc Jones, the lead SEC trial counsel during that unlawful decade-long crusade, was forced to concede in open court the caliber of the work, describing me as a hedge fund manager whose performance placed me among the top in the world.

The Deckers and Metals analyses were available to every paying subscriber of this Substack before the catalysts occured. They saw the “Margin of Safety”. They understood the “Moat”. They are now reaping the harvest of their disciplined adherence to value.

The market is entering a phase of extreme “Gnostic Heresy,” where valuations are based on “compute power” and “hallucinations” rather than cash flow. One can either stay in the darkness with the crowd, or one can join the few who see the world through the eyes of sobriety and discipline.

What is the next? What is the next legacy giant about to crumble like Nike, and which enterprise is positioned to capture its market share?

The answers are already being codified in our analysis. Don’t wait for the earnings release to tell you what the fundamentals have already signaled.

Upgrade to a paid subscription today. Secure your seat at the table of the vigilant.

Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute investment advice, financial recommendations, or an offer to buy or sell any securities. Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. Readers should conduct their own research or consult with a licensed financial advisor before making any investment decisions. The views expressed herein are those of the author and do not necessarily reflect the views of any affiliated organizations.

Long: TGT, UPS, DECK