Arithmetic Vindicated: The $19.2 Billion Answer to Market Panic

Comcast’s record 2025 results prove the "Smart Money" wrong. While the benchmarks melt down, the fortresses of value are standing firm.

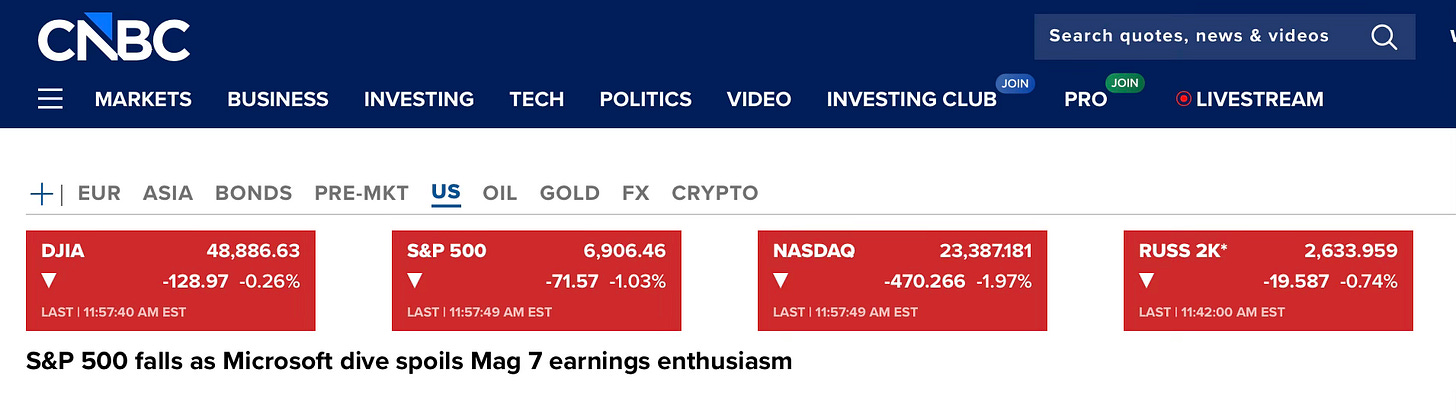

The broader market is currently gripped by a fit of institutional instability, yet today’s Comcast earnings release has provided a definitive answer to a question the “Smart Money” was too afraid to ask. Why are we finding safety in the “unloved” while the benchmarks melt down? As I write this, the NASDAQ is under significant pressure, shedding over 400 points as momentum-driven strategies unwind.

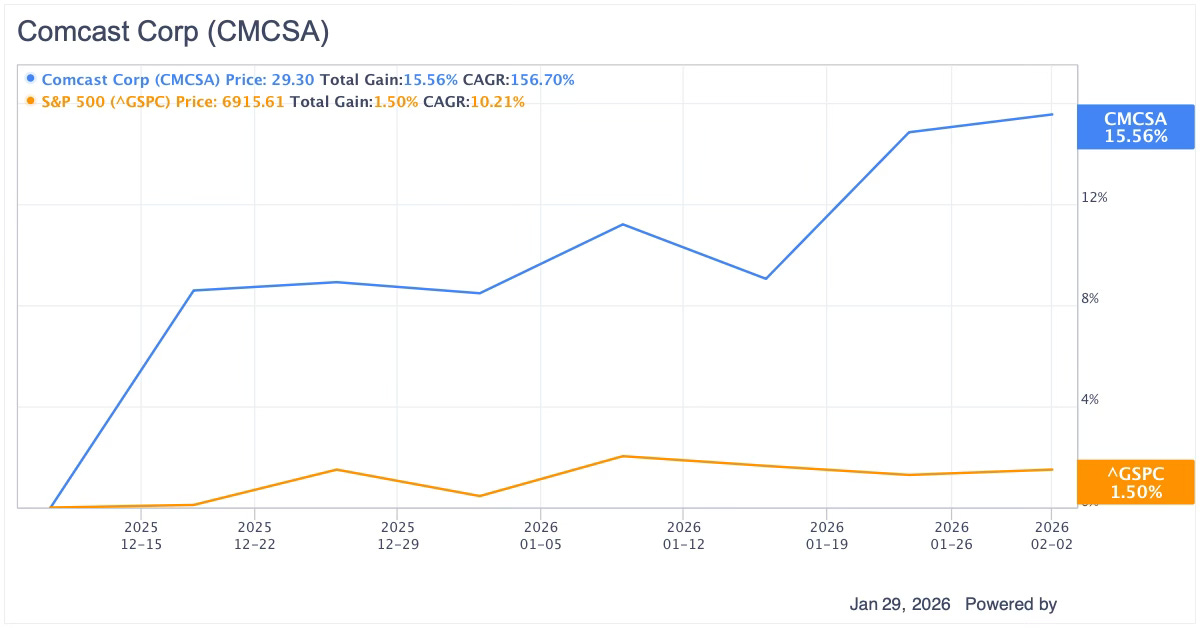

The S&P 500 is down over 1%. Yet, today’s results from Comcast (CMCSA) have provided the ultimate news hook: a total vindication of our December 11 thesis. While speculators scramble for the exits, the “unloved” Lemelson commitments are standing firm. Comcast surged as much as 5% today, while Target (TGT) and UPS, among others, followed the same uncorrelated path upward.

This is not a matter of fortune. It is the inevitable result of applying a rigorous Margin of Safety when the rest of the market is intoxicated by growth at any price.

The Intelligent Call: Vindicating the Thesis

On December 11, we presented Idea 14 to our subscribers. This was not a “tip,” but a sober assessment of an enterprise trading at a profound discount to its intrinsic value. We characterized Comcast as a “Cannibal” at 4x earnings, a business generating such massive cash flow that it could aggressively repurchase its own shares while the market was distracted by headline noise.

The “Street” focused on the decline of legacy cable. We focused on the economic moat of converged connectivity and the power of the balance sheet.

Today’s Q4 Earnings Release (January 29, 2026) provided the empirical proof:

Record Cash Generation: Comcast reported a record $19.2 billion in Free Cash Flow for the full year 2025.

The Structural Catalyst: We anticipated a “Value Unlock” through asset simplification. On January 2, the company completed the tax-free spin-off of Versant Media Group, creating a leaner, more focused NBCUniversal.

The Wireless Engine: While critics worried about broadband subscriber counts, Comcast delivered its best year ever in wireless, surpassing 9.3 million total lines with 1.5 million net adds in 2025.

Shareholder Yield: Management utilized its cash to reduce shares outstanding by 5% in 2025, returning a total of $11.7 billion to shareholders.

When a company buys back its own shares at a discount to intrinsic value, it is the most prudent act a management team can perform for its long-term owners. It is arithmetic in its purest form.

Uncorrelated Alpha: A Portfolio of Fortresses

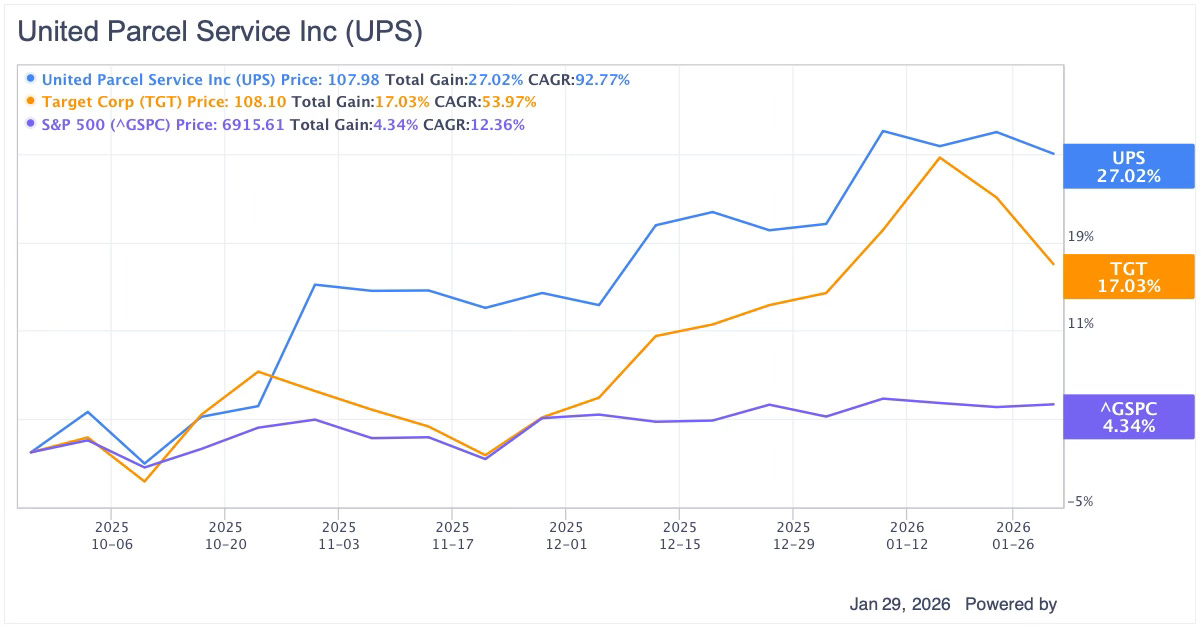

Comcast’s performance is part of a broader pattern of Uncorrelated Alpha. True diversification isn’t about owning more stocks; it’s about owning businesses that move according to their own internal compounding rather than the whims of the index. Other recent Lemelson ideas such as UPS and Target both published on September 25, 2025, also rose today even as markets sank.

UPS: Despite the “Amazon Illusion,” UPS maintains a logistical moat that allowed it to offer a 6.98% yield at a time when the market was fleeing from tangible assets.

Target: Since our September 25 analysis, Target has outperformed the benchmark, becuase of the signficant price-value dislocation we identitifed at the time and the fact the company continues to adhere to the principles of disciplined retail operations.

Why do these stocks rise while the market sinks? Because they are highly productive assets purchased with a substantial Margin of Safety. Their intrinsic value is grounded in the reality of the their financial statements, not the psychology of the crowd.

The Cost of Following the Crowd

The analysis that anticipated today’s 5% move (and nearly 16 percent since December 11) in Comcast was available to our paid subscribers in December. At that time, the consensus was fearful.

Will you continue to let the “Smart Money” manage your fears, or will you manage your own capital through the lens of objective reality? I have spent years defending these principles against institutional inertia and unlawful oversight. The truth is often found exactly where the crowd refuses to look.

Join the community of super investors.

To receive the deep-dive research and gain access to the “American Icon” (one of our best investment ideas) currently trading at a margin of safety too large to ignore.

Don’t just subscribe for information; subscribe for the transformation of your capital into a fortress.

Disclaimer:

The information provided in this article is for educational and informational purposes only and does not constitute investment advice, financial recommendations, or an offer to buy or sell any securities. Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. Readers should conduct their own research or consult with a licensed financial advisor before making any investment decisions. The views expressed herein are those of the author and do not necessarily reflect the views of any affiliated organizations.

Long: UPS, TGT