The $12 Billion Disconnect: A Forensic Autopsy of Idea #17

When a $2 Trillion engine is priced for terminal collapse, the arithmetic of despair becomes the geometry of opportunity.

In about 11 weeeks, you have pushed this publication to #58 on the global leaderboard in our category (there are 50,000+ publishers on Substack). Thank You.

LEMELSON ANALYSIS: IDEA #17 | CONVICTION RATING: 8/10

The Scene of the Crime

The opening bell on February 3, 2026, didn’t just start a trading day; it signaled a slaughter. In a matter of minutes, a digital ticker gapped downward as a sea of red erased nearly $12 billion in market capitalization. This wasn’t a “market adjustment,” it was a violent, irrational repricing of a global titan, suggesting a terminal failure that the balance sheet simply doesn’t show.

How can a firm moving nearly $2 trillion in annual volume be discarded as a “relic”? The institutional crowd is convinced the “moat” is dry, citing competition and “perpetual investment cycles”. Yet, they are ignoring a cash-generating engine that is currently idling at a once-in-a-generation valuation.

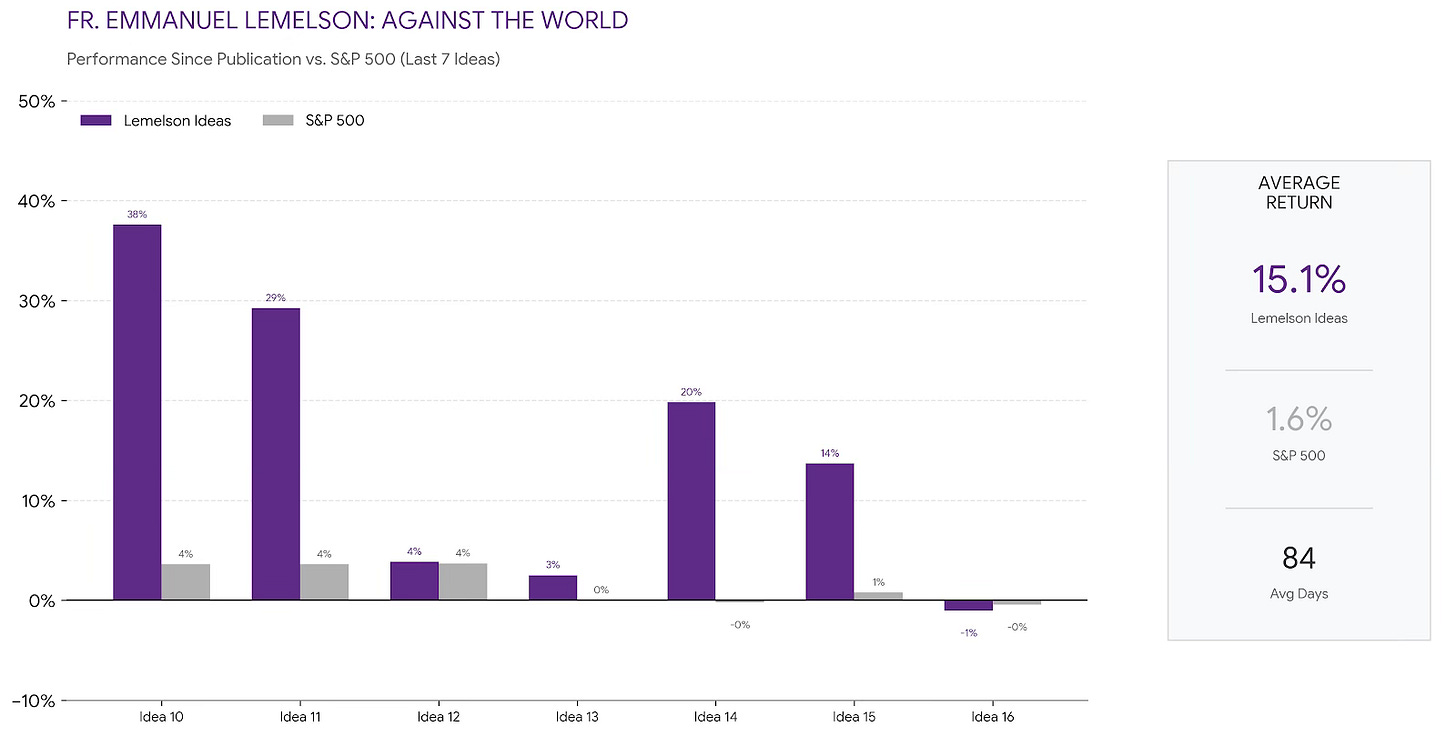

While the S&P 500 stagnates with a meager 1.6% return, our approach has allowed us to operate on a different plane.

THE POWER OF PRESCIENCE: Following the crowd is a recipe for mediocrity. While the benchmark is basically flat, our last seven investment ideas have not just outperformed, they have outperformed the S&P 500 by nearly 10x. From the deep-value recoveries of UPS and Target to the explosive growth of Deckers, our members were positioned before the pivot.