The Amazon Illusion: The Truth Behind the 6.1% UPS Yield

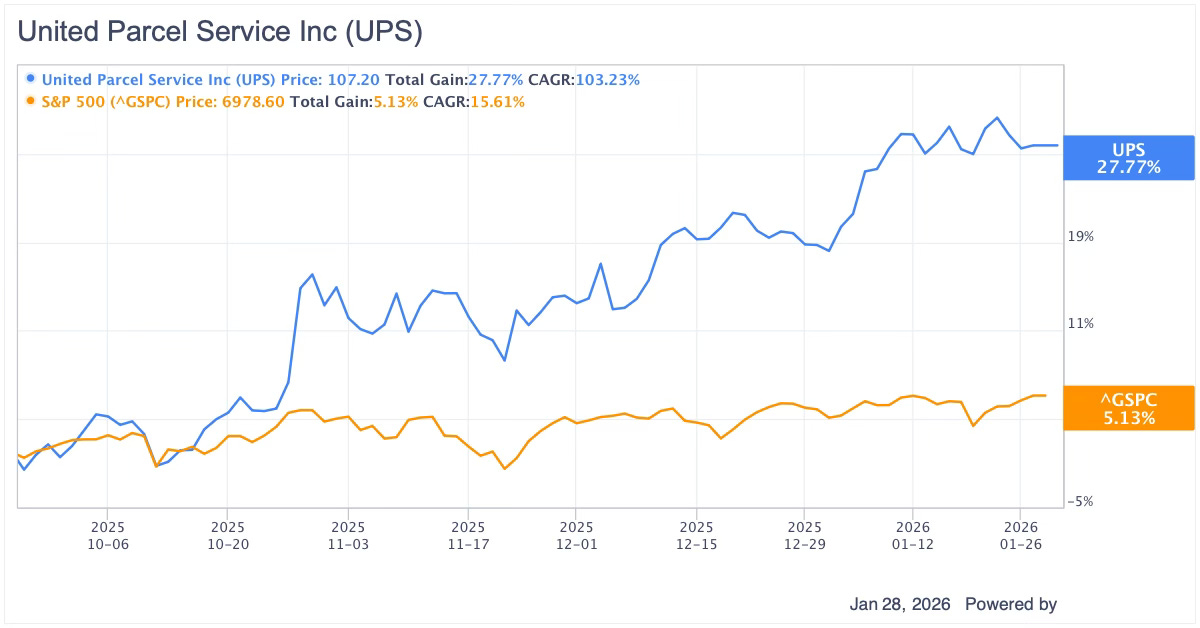

We caught the ~28% surge while the street stayed fearful. Inside: A fundamental weighing of intrinsic value and the $6.4 billion commitment to shareowners.

On September 25, 2025, while sell-side analysts were sharpening their knives for United Parcel Service (UPS), we were conducting a rigorous fundamental analysis of the business. The price was languishing near its 52-week low, discarded by speculators who couldn’t see past the next quarter’s volatility. They saw a “secular decline”; we saw a price-value dislocation that offered a significant margin of safety.

Since that analysis, the data has vindicated the patient investor. While the S&P 500 managed a tepid 5.13%, UPS has outperformed with a nearly 28% rise in its quoted market price in just four months.

But here is the question that separates the intelligent investor from the speculator: Is the intrinsic value fully realized? When a security moves this fast, the crowd can start to get skittish. They wonder if they should “take profits.” The masses are currently asking if UPS is “overbought.” They are asking the wrong question.

The Illusion of the “Amazon Glide-Down”

For years, the “experts” claimed that Amazon would leave UPS in a state of terminal decay. They treated the reduction in Amazon volume, another 1 million pieces per day planned for 2026, as a death sentence. It was a failure of analysis. They focused on the gross volume and missed the quality of revenue.

In our September analysis, we didn’t just look at the boxes; we performed a detailed examination of the financial statements to identify the company’s economic moat. We saw a management team intentionally shedding low-margin “junk” volume to focus on high-yield healthcare and B2B segments, which grew to 42.3% of total U.S. volume in 2025.

As CEO Carol Tomé noted in the Jan 27, 2026 call, 2025 was a year of “considerable progress” where UPS built a network that will deliver “differentiated logistics.” While analysts focused on volume declines, they ignored the 8.3% growth in revenue per piece and the $6.4 billion returned to shareowners through dividends and repurchases.

The Curiosity of the 28% Gap

We are now standing at a crossroads. The initial opportunity was captured by those who viewed UPS as a business to be owned, not a ticker to be traded. But as the price sits near $107, the relationship between price and value is shifting.

Did the sell-side get it wrong because they are focused on “voting” rather than “weighing”?

Is the 6.1% dividend yield a sustainable return on capital or a sign of stagnant growth?

Most importantly: After a ~28% rally, does a margin of safety still exist, or has the market finally caught up to the business’s true worth?

The crowd is waiting for a signal. The intelligent investor is looking at the owner earnings.