The Imperial Margin Call: Seizing Assets to Feed the Debt

Washington’s aggression is a desperate grab for collateral. Ignore the 'War Trade' at 40x earnings, buy the 'Cannibals' at 4x.

There is a specific kind of silence that falls over a market just before the realization hits. It is not the silence of peace; it is the silence of a held breath. We are standing on the banks of a new Rubicon.

For the last week, the cameras have been pointed at the jungles of Venezuela (“Operation Southern Spear”) and the ice of Greenland. The narrative being fed to the public is one of strength, a muscular restoration of order. Just this morning, the mainstream caught up to the reality we have been tracking for months. CNBC is reporting a massive surge in defense stocks as the administration signals historic increases in military spending, forcing Europe to underwrite the American arsenal.

“Nobody is going to fight the United States militarily over the future of Greenland.” — Stephen Miller, Deputy Chief of Staff, Jan 7, 2026

The mask did not merely slip this morning; it was discarded entirely. Mr. Market is now aggressively bidding up the “War Economy,” valuing defense primes and military contractors at historic premiums. But as we will discuss below, purchasing assets based on popular momentum rather than intrinsic value is often the fastest route to the permanent loss of capital.

However, the narrative that this is a sudden, chaotic impulse is historical illiteracy. The strategic necessity of the Arctic has been obvious to American statesmen for generations. In 1867, Secretary of State William Seward commissioned a report on the purchase of Greenland, recognizing it as a vital northern foothold. The logic persisted into the 20th century. In 1946, President Harry Truman formally offered Denmark $100 million in gold for the island. We are not witnessing a new madness, but the aggressive execution of a century-old imperial imperative.

The Theological Maxim: “Sinfulness is Lawlessness”

To understand the mechanics of this market, one must look beyond the balance sheets and into the pathology of power. In my recent discussion with Peter R. Quiñones, I defined this era as the “Golden Age of Fraud.”

The theological maxim cited in the interview, “Sinfulness is Lawlessness,” is the only framework that explains this volatility. When a governing body loses its moral center (Sin), it inevitably loses its capacity for consistent governance (Lawlessness). The law ceases to be a fixed standard and becomes a fluid instrument of power.

Yesterday, the Orthodox Church celebrated the Synaxis of St. John the Baptist. The Forerunner spoke truth not because it was safe, but because it was necessary. Herod Antipas, representing the insecure State, feared John because John possessed a moral authority that the Empire could not buy or conquer. Like Herod, the modern Empire believes that by silencing the messenger (or seizing the asset), it can secure its throne. But the lesson of the Forerunner is that Truth cannot be beheaded; it only rises.

I have witnessed this firsthand. The same “fluidity” of law that allowed the SEC to prosecute an innocent man for almost eleven years, ignoring exculpatory evidence to attempt to secure a narrative victory, is now being applied to international borders. TheUS Government is doing to Venezuela what it tried to do to in SEC vs. Lemelson: fabricate a pretext to seize assets. The scale is different; the “lawlessness” is identical.

Watch the full discussion on the “Golden Age of Fraud” here:

The “Safe Haven” Trap vs. The “Lemelson” Reality

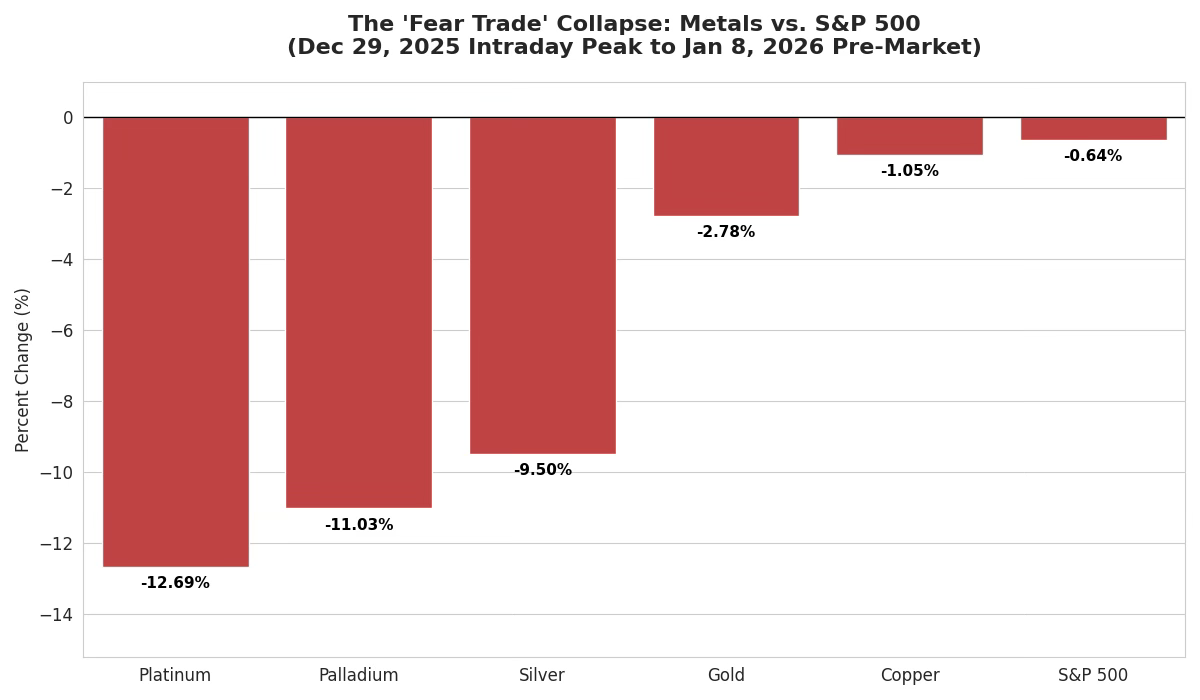

Throughout all of 2025, the herd piled into the traditional “Safe Haven” assets: Gold, Silver, and Platinum. The logic was standard: War is coming, the fiat currency is going to collapse. Buy insurance. Store value. But the market is a cruel teacher, and the lesson being taught right now is that in a liquidity crisis, there is no such thing as a safe haven.

December 29, 2025, marked a seeming turning point in the illusion. Since that date, on the eve the drums of war began to beat the loudest, metal prices have not soared. They have collapsed.

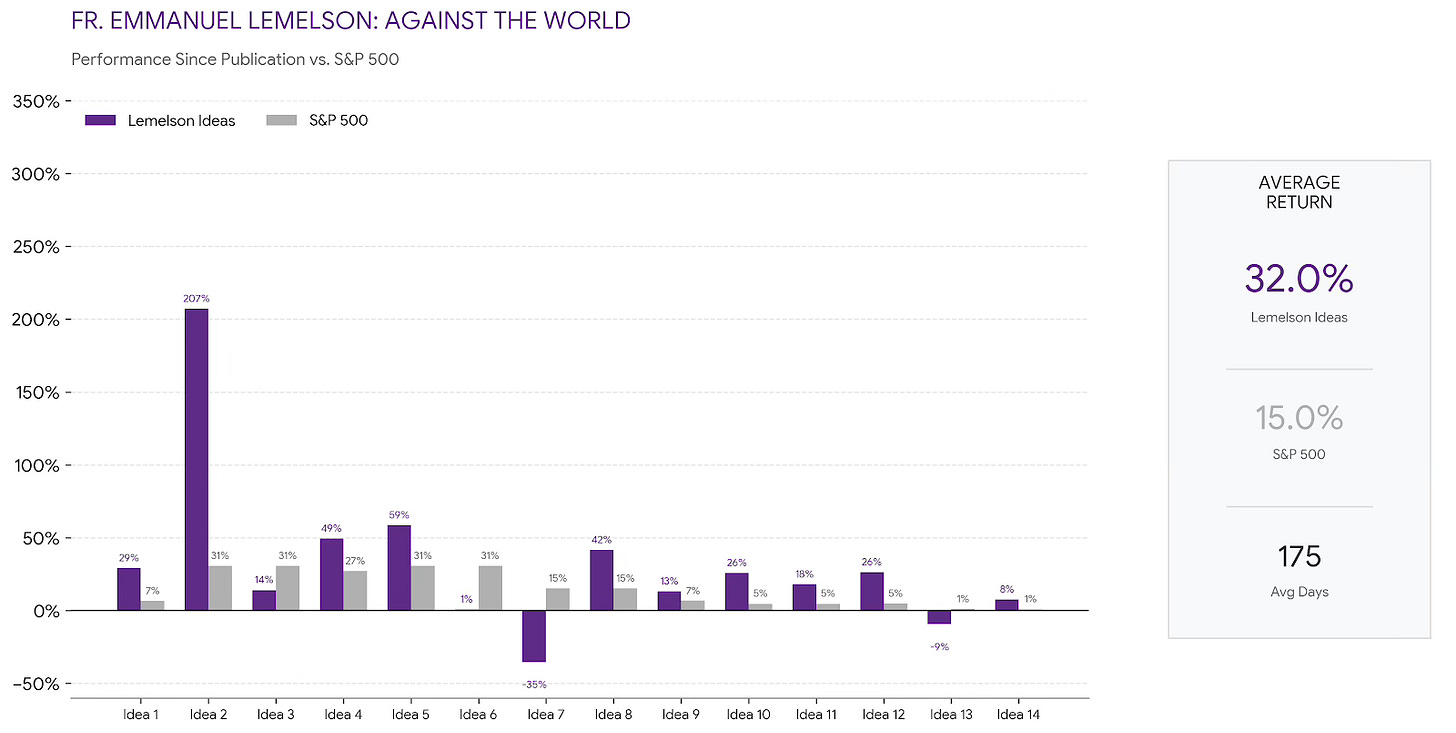

This is where the “Golden Age of Fraud” reveals itself. While the consensus spent 2025 chasing speculative commodities and is now chasing overpriced war stocks, the proprietary “Lemelson Ideas” basket has quietly outperformed by adhering to strict valuation discipline.

The scorecard for this specific epoch of volatility (Avg 175 Days) tells the only story that matters:

S&P 500 Return: +15.03%

Lemelson Ideas Return: +31.96%

Our analysis and ideas are not merely beating the benchmark; we are more than doubling it.

Consider our latest high-conviction addition, released to members just 28 days ago (Dec 11). While the consensus was bidding up gold for the ‘inevitable’ war, we identified a ‘Cannibal’—a cash-flow giant aggressively buying back its own stock at depressed valuations.

The result in less than one month?

S&P 500: +0.87%

Metals Basket: Collapsed double-digits.

The ‘Cannibal’ (New Idea): +7.68%

We didn’t need a war. We just needed math.

While the “fear trade” is dismantled, look at the bifurcation that occurred on the eve the Venezuela raid launched. The following “Safe Haven” collapse figures are from the December 29 turning point:

The “Fear” Trade (Consensus - The Losers):

If the world is truly on the brink of a kinetic global conflict, why is the “fear trade” dying? Because the weighing machine of the market has already rendered its verdict: the U.S. isn’t losing, it’s looting.

The Questions That Matter

The volatility being witnessed is not random. It is the result of a geopolitical architecture that is being demolished and rebuilt overnight. To navigate this, one must confront the questions the mainstream financial press, which often functions less as journalism and more as the investor-relations department for the political complex in Washington, is too afraid to ask:

Is this the Rubicon? Has the invasion of Venezuela and the threat to annex Greenland marked the point of no return for the American Empire?

The Shadow Swap: Is there a tacit, “shadow agreement” between President Trump and Vladimir Putin? Is the world witnessing a global “Sphere of Influence” swap, where the U.S. withdraws from Ukraine in exchange for Russia’s non-interference in the Western Hemisphere?

The Economic Blowback: If the U.S. is adopting a posture of absolute hegemony in the Americas, what does that autarky do to inflation, supply chains, and purchasing power?

The Capital Markets: If metals are dead, where is the capital allocated? (Hint: It’s not where the consensus believes).

Status Report: Top 100 & The Final Window

First, a specific note of gratitude. Because of your support, this publication has, after roughly eight weeks of consistent publishing, officially entered the Top 100 Bestsellers in Faith & Spirituality on Substack. This milestone confirms what we have long suspected: the world is starving for truth, not narrative.

We are now more than halfway through the enrollment window for the Founding Member tier. In the last few weeks, this community has navigated the DeepSeek anniversary setup, the Venezuela raid, and the Metals crash all before the broader market caught on.

There are only 12 days left to lock in the 50% Founding Member Discount. This is a courtesy notice to ensure those who value this level of insight do not miss the window.

The Wiring of a Super-Investor

In capital allocation, there is a hard truth: One cannot simply “learn” to be a Super-investor: it is not an intellectual skill; it is a wiring.

While the speculator chases the “War Trade” at 40x earnings, the Super-investor is wired to reject the consensus in favor of a mathematical margin of safety. We do not predict coin flips; we wait for the price to be undeniable.

This is the lesson of yesterday’s feast. St. John the Baptist lived in the desert not because he was poor, but because he refused to eat from the King’s table. To see the truth of this market, one must be willing to walk into the desert and ignore the feast of lies being served by the consensus. One must be an “Angel of the Desert.”

It is this same wiring that allows one to stand against the full weight of the U.S. government’s unlawful prosecution for eleven years and never blink. When you have stared down the State and prevailed, the opinion of the herd ceases to matter.

The herd bought metals in 2025 (down double digits). They are panic-buying defense stocks today. We are doing neither. Our ideas are up 31.48% because we identified the assets the narrative ignored.

History is rhyming. Below, we detail exactly where we believe the liquidity is flowing next.