The "Superinvestor" Protocol: +21% and +12% While the Market Slept

On Sept 25, we bought the unloved. Today, with NYSE Margin Debt going vertical, we reveal the two "fortresses" safe enough to own.

In his seminal 1954 work, The Great Crash of 1929, John Kenneth Galbraith introduced the concept of the “bezzle,” the inventory of undiscovered embezzlement that exists in a booming economy. In good times, money is plentiful, scrutiny is low, and the “bezzle” expands. It is only when the tide goes out, as Warren Buffett famously quipped, that we discover who has been swimming naked.

We are currently navigating the greatest accumulation of “bezzle” in financial history.

The 119% Signal: Why This Time is Different

Do you feel it? The disconnect between the stock market’s daily highs and the reality of the economy? You are not crazy. You are observing the terminal phase of a debt cycle.

The “Institutional Herd” is chasing AI narratives and momentum, willfully ignoring the flashing red lights on the dashboard:

The “Buffett Indicator” is Screaming: This metric is simply the total market capitalization of all U.S. stocks divided by the country’s GDP. It tells us the price we are paying for the economy’s output. Right now, that ratio has completely detached from reality, we are paying more for $1 of earnings than at almost any point in history. (Gray bars represent recessions.)

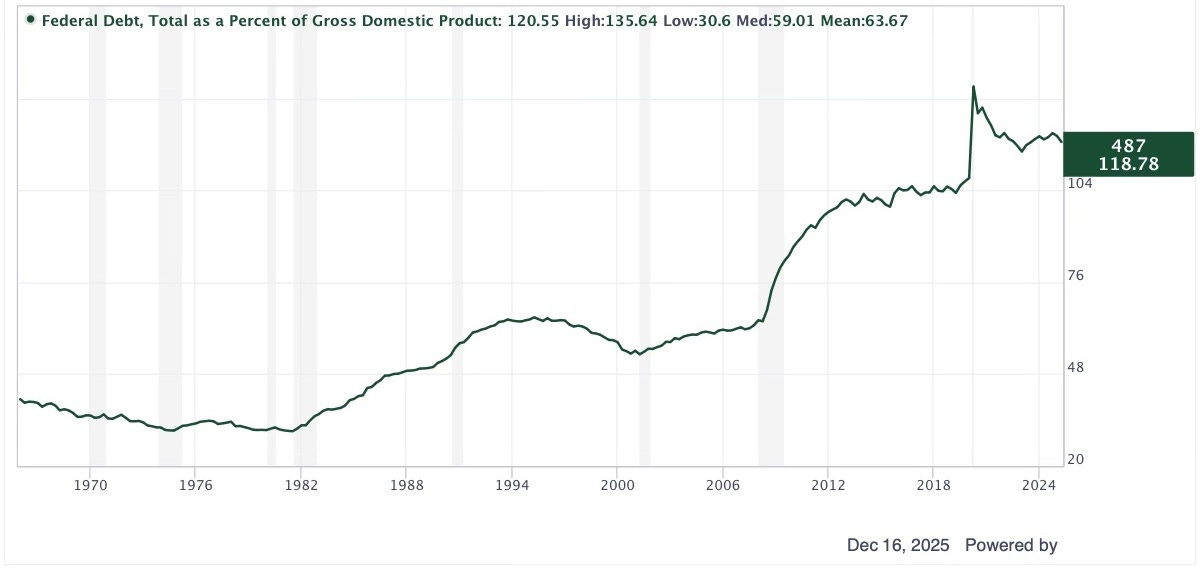

The Debt Trap (Solvency): As of 2025, the U.S. Sovereign Debt-to-GDP ratio has reached ~119%. Compare this to Germany (64%) or China (88%). We are in a debt-fueled asset bubble that mathematically cannot be sustained without a reckoning. (Early 2020 spike represents COVID-related shutdowns.)

The Margin Spike (Speculation): Perhaps most alarming is the NYSE Investor Margin Debt relative to GDP. As shown in the chart below, this metric has spiked to levels that historically precede a market collapse. This represents the “phantom equity” in the system. money borrowed by speculators to buy stocks. When the market turns, this liquidity does not just slowly exit; it evaporates.

In this environment, “return on capital” is a luxury. “Return of capital” is a necessity.

A Note on Resilience: Validated by the Adversary

True value investing cannot be learned in a classroom. It is forged in fire.

For nearly 11 years, I stood against the full weight of the U.S. government’s unlawful prosecution. I was hunted, targeted, and pressured to fold. I did not fold. I fought, and I survived.

My track record was so undeniable that even my adversary, the lead SEC prosecutor, was forced to admit the following to the judge and jury during my 2021 trial:

“…one of the top hedge fund managers, month after month on the top of the Barron’s list. This is not some schmo. This is a top hedge fund manager with top results in the world.”

— Marc Jones, Lead SEC Prosecutor, Day 7 of SEC vs. Lemelson Trial

Read: The Unlawful Prosecution of Fr. Emmanuel Lemelson

That battle taught me that “consensus” is often a lie. I apply that same battle-hardened discipline to the markets. I do not fear the crowd, and I do not fear the crash. I fear only the loss of truth.

The September 25th Scorecard: Proof

On September 25, 2025, in our article “Beyond the Hype: A Quantitative Hunt for Value,” we issued a specific protocol. We analyzed four companies against the backdrop of this bubble.

We have not provided an update on these targets since that publication. Today, less than three months later, the data confirms our “wiring” was correct.

Since September 25, 2025:

The S&P 500 has returned roughly 2.6%.

Target 1 (Transportation Giant): Has returned +21.43%.

Target 2 (Retail Titan): Has returned +12.74%.

While the crowd fought for scraps in an expensive market, our “unloved” value picks delivered massive alpha.

Target 3 (The “Value Trap”): We warned this stock lacked a sufficient margin of safety. It has significantly underperformed our top picks (returning just 2.32%).

Target 4 (The “Contrarian Play”): This stock has lagged. It is now cheaper than it was in September (down 13.48%). We are doubling down on our conviction.

The Architecture of Prescience

This vindication is not an isolated event. It is a repeatable pattern.

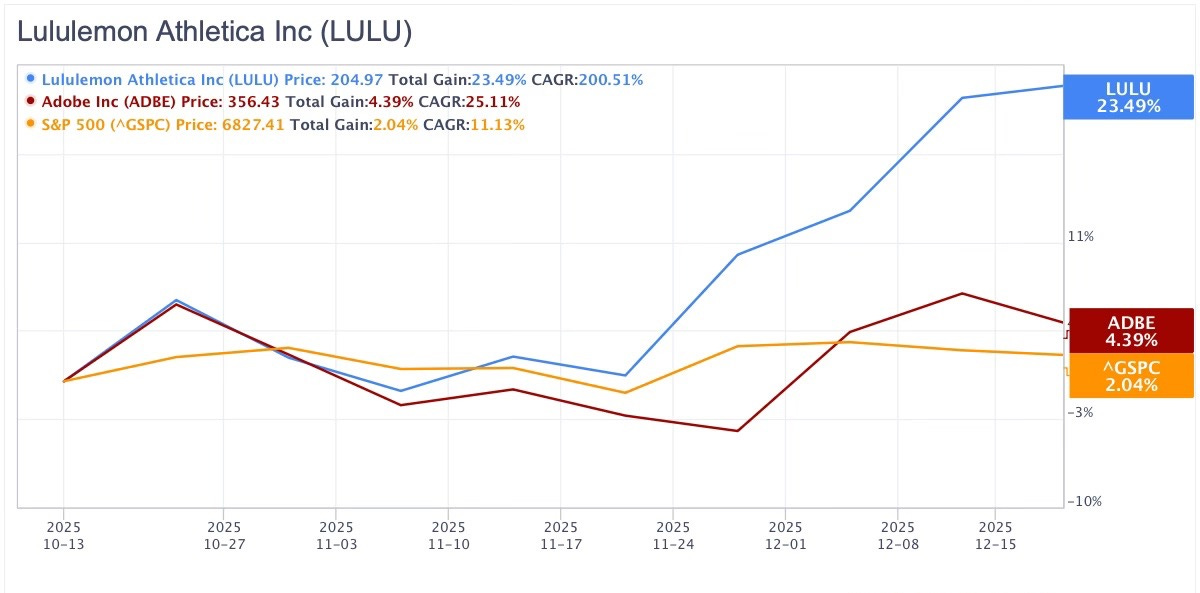

On October 14, in our article “The Illusion of a Rebound: Why Friday’s Crash is Not Over,” we warned that the market’s optimism was misplaced. While others chased the “rebound,” we focused on fortress balance sheets like Lululemon (LULU) and Adobe (ADBE).

The same “wiring” that identified basically the bottom in LULU and the value in ADBE, as just the latest in our string of wins, is what drove our +21.43% gain in “Target 1.” And it is exactly what is driving our conviction in the two names below.

If you want analysis from a “Superinvestor” who has been battle-tested by the US Government and validated by his own prosecutors, join us.

We are currently offering a 50% discount on Founding Memberships (only 35 days remaining).

[SUBSCRIBE NOW: Get the “Fortress” Tickers]