When the Narrative Breaks

The Empire seizes $17.3T in oil, the lights go out in Caracas, and the "Safe Haven" collapses.

The Silence of the Safe Haven

The President of the United States has just declared that America will “run” Venezuela.

It is a statement of absolute dominion. But while the White House promises order, the reality on the ground is chaos. Confirmed reports from Caracas describe “engineered” electrical blackouts plunging the capital into darkness, accompanied by a series of massive explosions rocking the southern districts.

The “Department of War” has arrived.

But while the lights go out in Venezuela today, the financial narrative of the “Safe Haven” had already burned out days ago.

On December 29th, five days before the first US boot hit the ground, the script cracked.

Let us be clear: this invasion was no surprise. The United States had been building up a massive military presence around Venezuela since September. The “Expert Class” had promised that this was the moment. With troops massing and the invasion imminent, Gold was supposed to soar. Platinum and Palladium were supposed to become unobtainable.

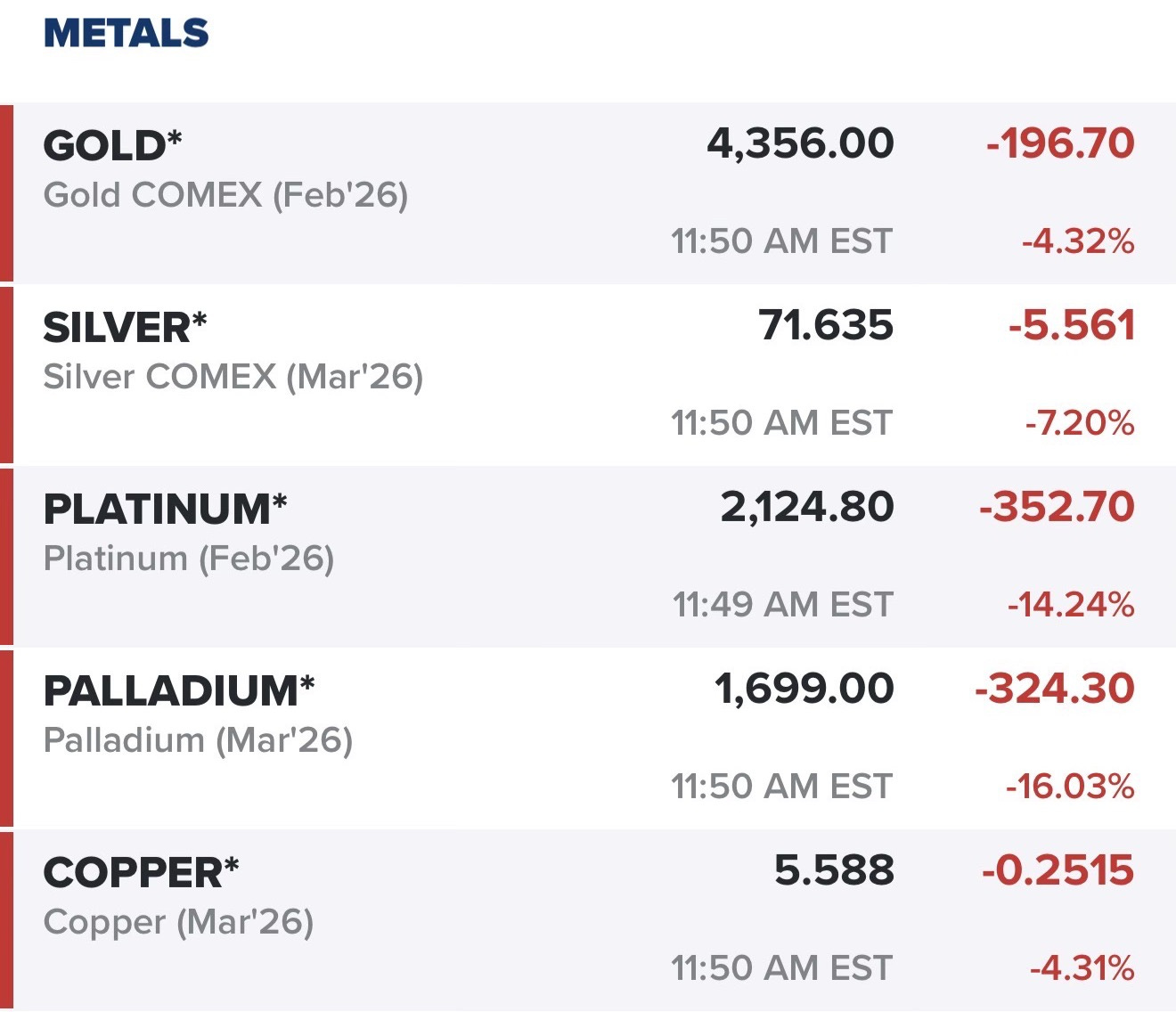

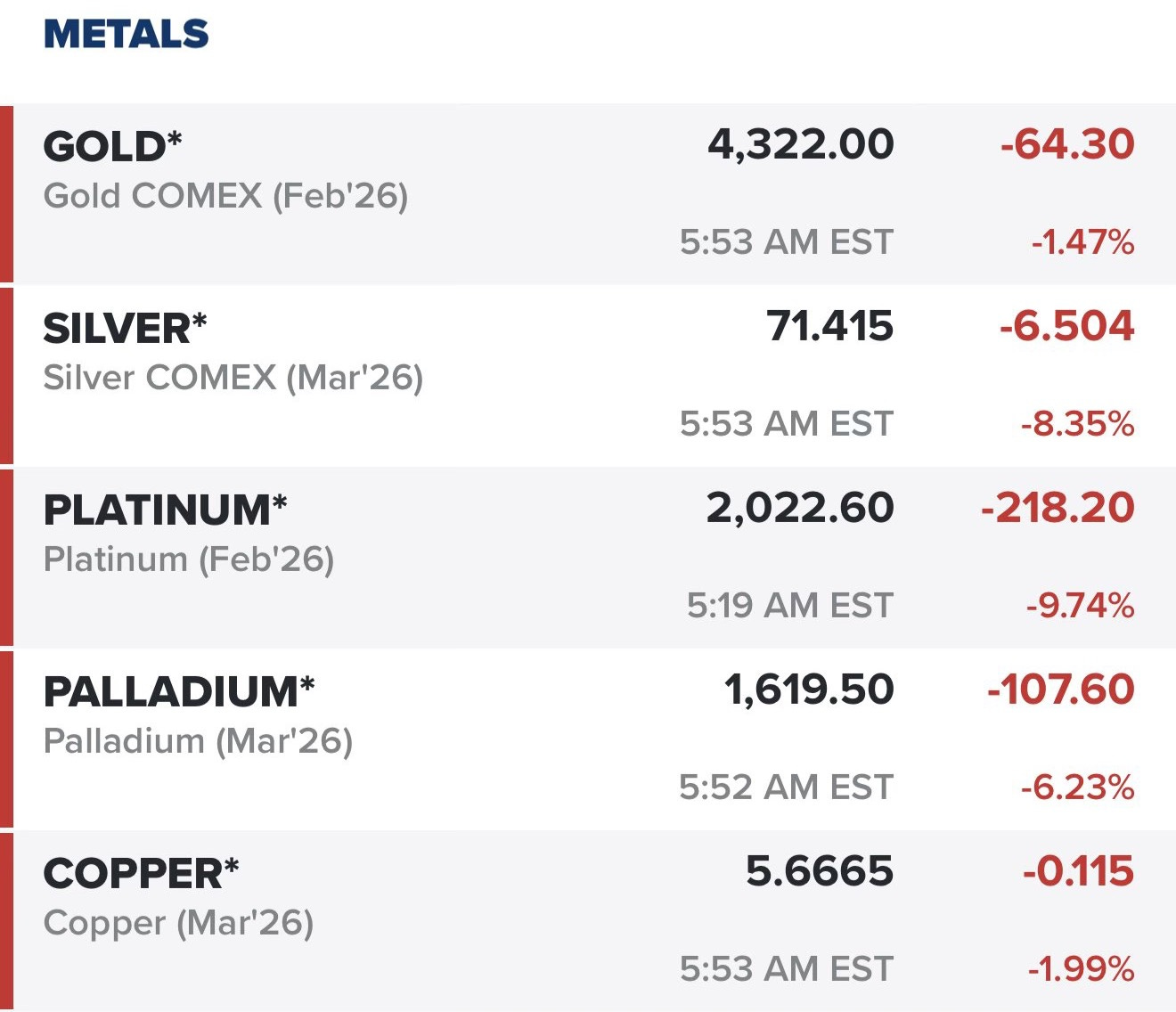

Instead, on the very eve of the conflict, the floor fell out.

While the “Empire” postured, the markets delivered a brutal, silent verdict. On December 29 Platinum collapsed by nearly 14%. Palladium shed over 16% of its value. Even Gold and Silver, the supposed divine constants of the prepper portfolio, dropped approximately 4.5% and 7.5% respectively. The carnage continued on December 31.

The timeline is the ultimate judge. If these assets cannot hold a bid days before a widely anticipated invasion, they are not hedges. They are traps.

For the investor staring at a block of depreciating metal while watching the Empire claim control over a sovereign nation, the question for 2026 is deeper, uncomfortable, and necessary: “Am I investing with my eyes wide open, or am I just following the herd?”

The False Prophecy of Dominion

We did not arrive here by accident. The “War Trade”—the belief that military conflict automatically enriches the cautious hoarder, is based on a misunderstanding of both economics and theology.

Months ago, on September 4, we warned that the “Department of War” operates on a specific heresy: the belief that man can impose righteousness through Dominion.

When the President states, “We’re going to run the country,” he is articulating the ultimate expression of this heresy. In Episode 45, we described this error as “trying to force a garden to bloom before its season.” It is the belief that the State can usurp the role of Providence and freeze history into an outcome of its choosing.

Make no mistake: this operation is not about “restoring democracy.” It is about seizing control of proven oil reserves valued at approximately $17.3 trillion. It is about reasserting strategic dominance to secure the Petrodollar.

More chillingly, it is a preparatory move. By securing a reliable energy source in our own hemisphere, the Empire is building a “buffer” against supply shocks in the Persian Gulf. They are making a future confrontation with Iran “economically manageable.” They are not liberating a nation; they are rearranging the chessboard for the next war.

But “Dominion” always carries a cost. The blackouts sweeping Caracas today are the physical manifestation of this spiritual error. The Empire promises “enlightenment” (order and democracy) but delivers only actual, physical darkness. And as history warns, if the U.S. faces sustained resistance in this new theater, it will drain the very political capital it seeks to project.

In Episode 45, we warned that the ‘Department of War’ seeks dominion, but brings only chaos.

In Episode 52, we analyzed the buildup in the Venezuela corridor. We argued that the government's sudden interest in "drug boat strikes" was a "cinematic posture," a pretext for power. The market sniffed this out before the first shot was fired. It knows that a "syndicate with a spreadsheet" (the modern State) does not create value; it consumes it, just as it is consuming the sovereignty of a nation right now.

The Fallacy of the Static World

This desire for static control, to freeze the world in a state of crisis, is not just a political error. It is an investment error.

“But Father,” the critics say, “what about the industrial use case? What about the AI boom? What about China restricting silver exports on January 1st?”

This is the Industrial Fallacy. Just as the State bets against the complexity of a nation, the “Stacker” bets against the complexity of the market.

1. The “China Syndrome” (Why Restrictions Fail): Stackers are pointing to Beijing’s new export licensing regime (effective Jan 1) as proof of a shortage. They are missing the second-order effect. China is restricting exports to keep domestic prices low for their own solar manufacturers. This artificial distortion doesn’t create a global floor; it incentivizes the rest of the world to accelerate substitution.

2. The Reality of “Utility” (Gold vs. Silver): The “Stacker” assumes that industrial demand guarantees a price floor. The data disagrees.

Gold: According to the World Gold Council (2024), less than 8% of annual gold demand comes from technology and industry. It is not a factory input; it is a fear gauge.

Silver: While The Silver Institute reports that industrial use accounts for ~55-60% of demand, this is not a safety net, it is a liability. Industrial producers are incentivized to lower their costs. When prices spike (or China restricts supply), industry doesn’t just pay up; it engineers around the problem. Thrifting in solar cells is already accelerating.

3. The AI Bubble Risk: If the current demand is driven by the hyperscalers building out AI infrastructure, we must ask: Is this demand organic, or is it a bubble? If the AI thesis faces a correction, the “infinite demand” evaporates.

Both the Empire and the Stacker make the same mistake: they bet against Life. They bet that human ingenuity will fail, that problems cannot be solved, and that the only safety lies in force (Dominion) or hoarding (Scarcity).

The Verdict of the Math (and the Soul)

We saw the fragility of these narratives on full display recently.

In our appearance on Wall Street Bullion, we laid out the case against “stacking” using hard fundamental data. We noted how silver hit nearly $83 before crashing immediately. This collapse (to ~$72) confirms our thesis: these are not divine constants. They are speculative assets punishing those who bought them out of fear.

This episode walks through the specific market fundamentals that signaled the “Safe Haven” was a trap long before the first shot was fired.

But the issue goes deeper than the ticker tape. There is a spiritual dimension to this.

In the Patristic tradition, hoarding resources in a dark safe, waiting for civilization to collapse, is a form of acedia (spiritual sloth). In Episode 53, we defined this not just as laziness, but as "interior paralysis," a state where "nothing feels worth doing"and the soul demands sedation.

The “Stacker” mindset is often a symptom of this paralysis. It is the burying of the talent because one is too afraid to plant the garden.

We argued that the “Unholy Trinity” of political power, financial hedging, and personal comfort is a trap. The only true escape from the “Matrix” isn’t a metal vault, it’s repentance (a change of mind).

The Pivot to “Deep Value”

While the "Safe Havens" were decimating portfolios last week, something else was happening in the quiet corners of the market. The high-conviction ideas we have shared with our subscribers, productive, cash-flowing businesses that serve real human needs, were not crashing. They were compounding.

We have spoken at length about the specific metrics that led us to opportunities that outperformed the market. These were not guesses. They were the result of applying a rigorous framework.

The Crucible of Conviction

The “Super Investors”—those rare few referenced in the famous Graham and Doddsville essay are not made in business schools. They are wired differently.

For us, this clarity was forged in the fire of an 11-year battle against unlawful prosecution. When you stand alone for over a decade against the full weight of the State, knowing you are right when the world says you are wrong, you develop a muscle that most investors never use.

We proved this when we exposed the massive accounting fiction at Ligand Pharmaceuticals while the regulators were hunting us. We learned then to spot the “Bezzle”—the inventory of undiscovered fraud.

The loud power is in Caracas today. The loud power is in the “Safe Haven” narrative. But the Truth is in the quiet work of stewardship.

A Note of Gratitude

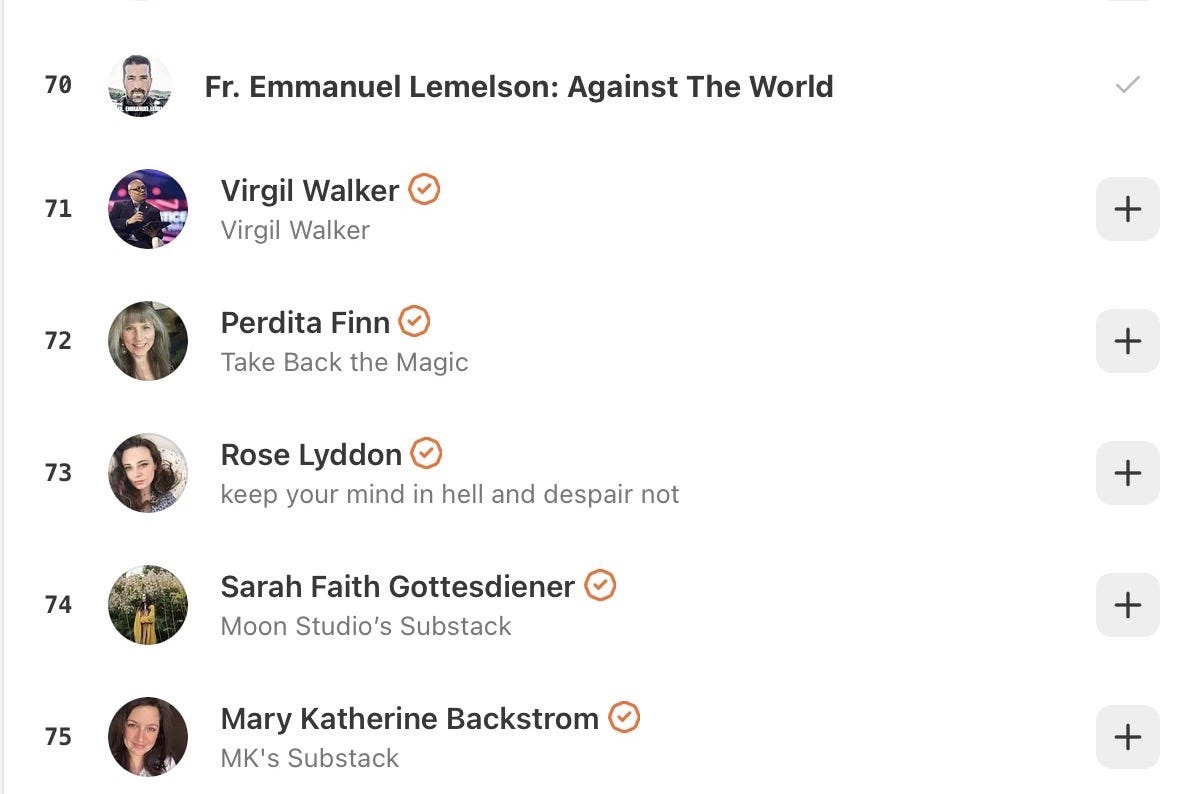

This week, thanks to you, this publication entered the Top 100 Bestsellers in Faith & Spirituality on Substack.

To be in the top 1% of over 50,000 publishers is a humbling validation of our shared thesis: people are tired of the noise. You are starving for a perspective that integrates the financial with the spiritual, the temporal with the eternal.

Thank you for trusting us with your time and your attention.

Status Report: The Founding Member Opportunity

We are now entering the final stretch of the enrollment window for our Founding Member tier.

While this newsletter provides the philosophical framework, our best investment ideas, the specific tickers and deep value analysis, are shared exclusively with our paid subscribers.

In recent months, we have:

Predicted the collapse of the “Safe Haven” metals trade before the invasion.

Identified deep value divergences that have generated significant alpha.

Provided a theological framework for understanding the “Department of War.”

The 50% off Founding Member discount is our way of building the core community that will travel with us through what promises to be a volatile year.

There are only 16 days left to lock in this rate.

Come for the finance. Stay for the truth.

Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute investment advice, financial recommendations, or an offer to buy or sell any securities. Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. Readers should conduct their own research or consult with a licensed financial advisor before making any investment decisions. The views expressed herein are those of the author and do not necessarily reflect the views of any affiliated organizations.

The timing of market movements versus geopolitical events tells a revealing story. When the narrative that's been building for months suddenly fails to align with actual market behavior, it forces a reassessment of assumptions. Your analysis of how the "safe haven" trade collapsed days before the invasion is a compelling example of markets pricing in reality rather than rhetoric.