The Digital Ouroboros

Wall Street has built a Tower of Babel to cheat the wages of sin. They believe "Chips,"refined sand, can supplant Grace. But the serpent is eating its tail, and the collapse has begun.

Listen to the hum.

It is the sound of a trillion dollars of server farms, humming in unison across the data centers of Northern Virginia. It is the sound of the Ouroboros, the ancient serpent eating its own tail, reborn in silicon.

The "Priesthood" of Wall Street tells you this hum is the sound of perfection. They tell you that the ascendancy of Artificial Intelligence has finally solved the riddle of the market. They claim that because the machine can process a petabyte of data in a microsecond, the "gap" between price and value has been closed forever.

They tell you that judgment is dead, that wisdom is obsolete, and that the only rational act left for the human being is to surrender their capital to the algorithm.

If you listen to them, the game is over. The machine has won.

But if you stop listening to the hum and start looking at the plumbing, you will see something the algorithms are blind to.

A fatal paradox is growing inside the “perfect” system.

It is a specific, structural flaw that appears in the markets only once in a generation. It occurs when a new technology is weaponized by leverage to justify valuations that defy arithmetic.

We are standing on the precipice of the most violent dislocation between price and value in history.

Why?

Because the market is currently more expensive and more systemically leveraged than at any point since 1929.

The “Buffett Indicator” (Market Cap to GDP) has breached 200%, higher than the Dot-Com bubble. NYSE Margin Debt has gone vertical. The “Price” assumes perfection; the “Value” assumes reality. The gap between the two is no longer a gap; it is a canyon.

The experts say the market has never been smarter.

I am here to tell you it has never been more foolish.

The Map for the Perplexed

To understand the trap the market has set for itself, we must turn to the economist and philosopher E.F. Schumacher. In his masterpiece A Guide for the Perplexed, Schumacher warned of a fatal error he called “The Loss of Verticality.”

He explained that reality is built on four distinct “Levels of Being,” and crucially, a lower level can never comprehend a higher level.

Level 1: Mineral. Dead matter. Its power is simply to be.

Level 2: Plant. Life. Its added power is growth and organic compounding.

Level 3: Animal. Consciousness. Its added power is motion, instinct, and emotion.

Level 4: Man. Self-Awareness. His added power is meaning and discernment.

Wall Street’s fatal error is believing that AI (Level 1: Mineral) can solve the market.

They have forgotten that the market is not a math problem; it is a living organism. It relies on compounding (Plant), it is driven by fear and greed (Animal), and it requires judgment (Man).

By handing the keys to Silicon, refined sand, they have used a dead tool to measure a living world. The algorithm can calculate, but it cannot Live, it cannot Feel, and it certainly cannot Discern.

This is why we must reclaim the “Hierarchy of Knowing.” To navigate each level of Schumacher’s reality, we require a specific Greek faculty. The machine possesses only the first; the Investor must master all four.

1. The Mineral Faculty: Techne (Τέχνη) This is the domain of the Machine. It is craft, skill, and calculation. AI is the ultimate master of Techne. It can drill a fiber optic line through the Allegheny Mountains to shave three milliseconds off a trade, a feat of engineering described in Michael Lewis’s Flash Boys. It is precise, it is fast, and it is impressive. But it is dead matter. It handles the Mineral level perfectly, but it knows the price of everything and the value of nothing.

2. The Organic Faculty: Sophia (Σοφία) This is the virtue required to understand the Plant level, the organic laws of growth. But Sophia (Wisdom) is distinct from mere knowledge; it is the Ordering of Knowledge. The machine can view a rumor on Reddit and a 10-K filing as equal "tokens" to be processed. It has no genuine hierarchy. Sophia knows that one is noise and the other is signal. It knows that Character is superior to Momentum. It distinguishes the Important from the Trivial. The machine has data; Sophia has Order.

3. The Behavioral Faculty: Phronesis (Φρόνησις) This is the virtue required to navigate the Animal level, the “Animal Spirits” of the market. Phronesis is practical wisdom. It is the ability to sit in a room while the herd is stampeding in fear and discern that the danger is an illusion, but the opportunity is real. The Silicon (Mineral) reacts to the herd; Phronesis (Man) governs it.

4. The Spiritual Faculty: Diakrisis (Διάκρισις) This is the virtue of the Watchman, required to protect Man. It is Discernment, the spiritual capacity to distinguish between the Spirit of Truth and the spirit of error. Crucially, Diakrisisis rooted in Charity (Agape), for only the eye purified by the love of Truth can detect the lie. The machine cannot Love; therefore, it cannot Discern. When the “math” says a Ponzi scheme is safe (see: Madoff, Enron, or the current AI bubble), Techne is fooled. Diakrisis is not.

The Genealogy of Error

When you view the market through Diakrisis, you realize that the devil does not create new sins; he simply rebrands old ones. The mechanism of hubris evolves, but the spiritual DNA remains identical.

We have heard this siren song before:

1929 (The Trust): The “Investment Trusts” used leverage to buy each other’s shares. It was a hall of mirrors that dazzled the public. Their evangelist, Irving Fisher, famously claimed they had engineered a “permanently high plateau of prosperity.” The liquidity evaporated in days.

1960s (The Conglomerate): The “Go-Go” era brought us the “Synergy” myth. Men like Harold Geneen at ITT convinced the world that by mashing up a bakery, a hotel chain, and a defense contractor, they could create magical “synergies.” It was accounting alchemy, using the high P/E stock of the parent to buy low P/E businesses, artificially inflating earnings per share without creating a single dollar of real value. It was a spreadsheet trick disguised as genius.

1987 (The Formula): By the 80s, the “Quants” had arrived. They sold “Portfolio Insurance”—a mathematical algorithm designed to automatically short futures when the market dropped. It was supposed to eliminate risk. Instead, on Black Monday, the machines all triggered at once. The autopilot didn’t save the plane; it flew it into the mountain.

1998 (The Nobels): Long-Term Capital Management was run by Nobel laureates who believed their models had mapped every probability. They were picking up nickels in front of a bulldozer. When the “impossible” happened in Russia, their leverage threatened to collapse the global financial system.

2008 (The Tranche): The ratings agencies told us that if you bundled a thousand toxic subprime loans together, the “math” made them AAA. They confused complexity with safety.

2025 (The Model): On “DeepSeek Monday” (Jan 27), the market finally saw the crack in the dam. A Chinese startup replicated the performance of a $100 million U.S. model for just $6 million, wiping $600 billion of market cap from the hardware giants in a single session. It proved that the “Capex Moat” was a lie. Efficiency (Man/Logic) defeated Brute Force (Mineral/Scale).

And now, we have arrived at the apotheosis of this lineage.

The devil is a master of irony, and nowhere is this clearer than in the nomenclature of our ruin.

In 1929, the vehicles of destruction were called “Trusts,” yet they were the most untrustworthy financial products ever invented.

Today, we worship “Chips.” We call them “Smart” and “Super-Intelligent.” But the linguistic irony should not escape us: A “chip” is merely a fragment, a broken piece of stone. We have pinned the economic hopes of humanity on “Smart Chips” that are, ontologically speaking, as dumb as the rocks they are refined from.

Mark Twain reminded us that history does not repeat, but it rhymes.

In 1929, they promised a “Permanent Plateau.” Today, the AI prophets promise an “Age of Abundance” and “Universal Basic Income.” The vocabulary has shifted from finance to utopia, but the delusion is identical: The belief that a new technology has finally liberated us from the laws of scarcity and the consequences of debt.

But here the Greek mind sees what the algorithm misses. In the ancient Scriptures, the word for "debt" (opheilemata) is inextricably linked to "sin." The price of the Fall in the Garden was the curse of toil, that Man must labor for his bread. The AI promise of "Abundance without Labor" is therefore not just an economic error; it is a theological rebellion. It is a misguided attempt, literally hamartia (ἁμαρτία), "missing the mark," to cheat the wages of sin. It seeks to return to Paradise through silicon rather than repentance.

They believe the Mineral (AI) can provide for Man without the need for the Plant (Growth) or the Animal (Labor).

Ultimately, they believe they can reach the Divine without the need for Grace.

It is the final Loss of Verticality: The attempt to create ex nihilo, to make something from nothing, and in doing so, to become gods.

The Ouroboros: An Incestuous Loop

The ancients spoke of the Ouroboros, the serpent eating its own tail. It was a symbol of infinity, but also of self-destruction.

Today, the AI sector has become a digital Ouroboros. But to the Watchman, this serpent looks familiar. It is the same creature that appeared in the Garden, whispering the same lie: That if you eat of the Tree of Knowledge (Techne) of Good and Evil, you shall be as gods, without the need for God.

The current mania is unique in history because it is incestuous.

On one hand, Silicon builds the framework of the new market. It is the architect. The high-frequency trading algorithms, the passive flows, and the sentiment scrapers are all built on the promise of Techne. They demand efficiency.

On the other hand, Silicon is the symbol of the excess. It is the very asset being traded.

This duality has birthed the “Round-Trip”—the rotten fruit of the new economy.

We are witnessing a closed loop where Big Tech Giants invest billions into AI startups. Those startups, having no other customers, use that cash to buy “cloud credits” back from the Big Tech Giants.

Money goes out the front door as “Investment” and comes back in the back door as “Revenue.”

This is not organic growth (Level 2). It is accounting sorcery (Level 1).

But here is the incestuous part: It is exactly what John Kenneth Galbraith described as “The Bezzle”—the inventory of undiscovered embezzlement that expands during a boom. The AI trading algorithms (the Framework) read this fake “Revenue” (the Symbol) and bid the stock up. The machine validates the fraud that the machine created.

It is a hall of mirrors where the algorithm looks at the reflection of its own hype and calls it “Growth.”

The Tower of Babel

The “experts” call this the Efficient Market Hypothesis in action. They say the market is pricing in the future.

We call it what it is: A Tower of Babel.

Their theologians, men like Sam Altman, measure progress by the “Kardashev Scale,” dreaming of a civilization that captures all the created energy of a star to power their silicon god. They are obsessed with Created Energy (Gigawatts), believing that if they just burn enough electricity, the machine will wake up.

They do not understand that true Life is sustained only by Uncreated Energy, the Grace of God. One is a resource to be burned; the other is a gift to be received. They are starving the grid to feed an idol that will never have a soul.

They are building a structure of infinite complexity on a foundation of circular logic. But the machine, trapped in the Mineral level, lacks Sophia (Wisdom) and Diakrisis (Discernment). It cannot distinguish between the truth (organic cash flow) and the lie (engineered hype).

It amplifies the panic. It condenses the folly. And when the liquidity stops, when the serpent finishes eating its tail, the collapse will be total.

The “White Edge”

If the machine has abdicated judgment to a feedback loop of folly, upon whom does the burden of Truth fall?

It falls upon the Steward. It falls upon the Soul.

In a market obsessed with the “Black Edge” of insider information and the “Speed Edge” of latency, the only remaining advantage is the “White Edge.” This is not an advantage of information, but of character. It is the alpha of Virtue.

Temperance: When the machine offers you a “Cannibal” (a company eating its own shares) at 4x earnings because it is “boring,” you take it. You reject the dopamine hit of the high-flying tech stock. You choose the quiet compounding of the Plant over the manic buzz of the Mineral.

Fortitude: When the algorithm crashes a stock because of a quarterly miss, you have the courage to stand alone. G.K. Chesterton reminded us, “I’ve searched all the parks in all the cities and found no statues of committees.”As we celebrate the Feast of St. Stephen this week, we are reminded that the crowd is often wrong, and the truth is often held by the one man standing against them.

The AI is a committee of billions. The Investor is an individual.

They are building their Tower. Let them build it. We know how that story ends. The collapse is not a possibility; it is a certainty written in the laws of nature.

And when the dust settles, our vocation is not panic, but patience. We will be waiting amidst the ruins, ready to recover the foundations the builders rejected.

P.S. The Proof of Discernment (Diakrisis)

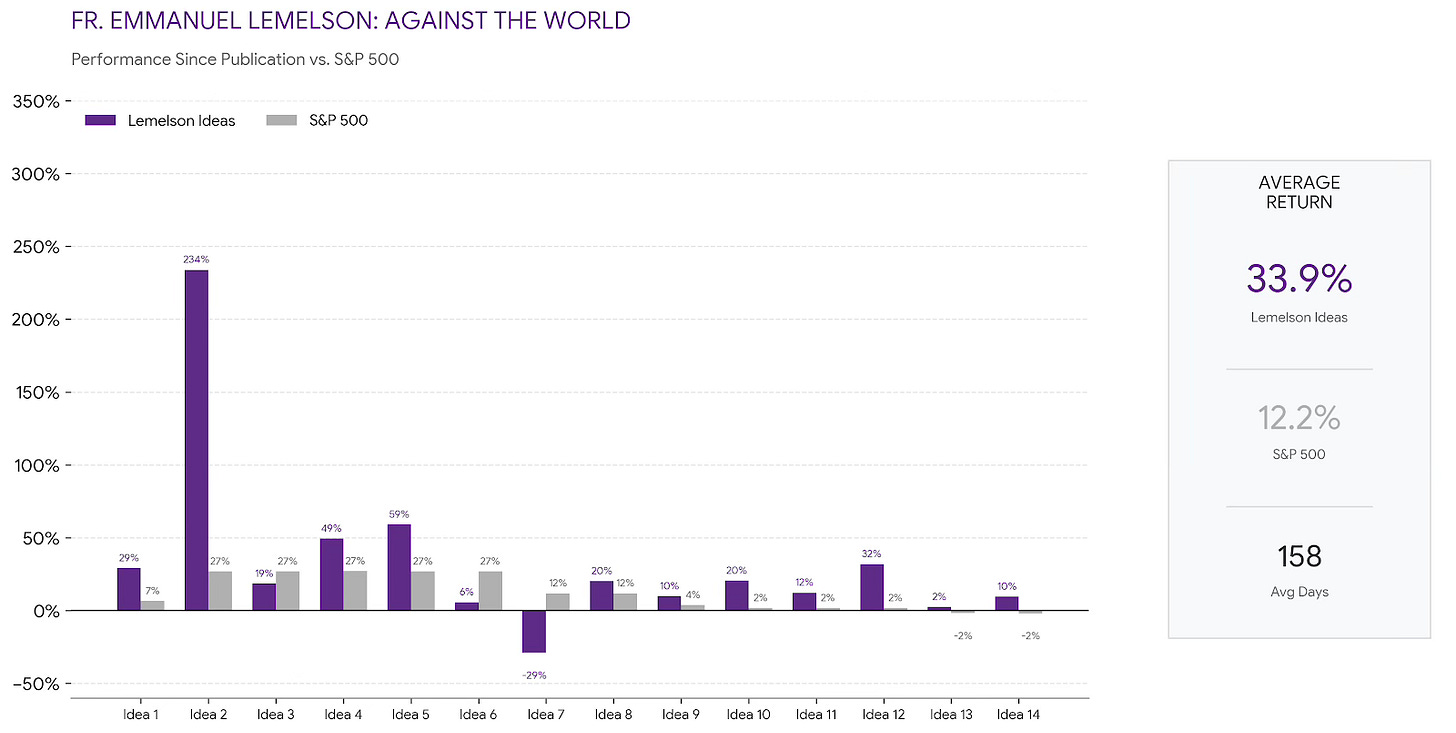

This philosophy is not theoretical. While the algorithms have been chasing the “Ouroboros,” we have been executing on the discipline of the Watchman.

Since we began publishing our high-conviction ideas for subscribers, the results have been definitive:

14 Ideas Published.

13 Positive Returns (so far).

11 Beating the S&P 500 Benchmark (so far).

The machine is fast, but it is blind. We are patient, but we see. We are have identified multiple stocks trading at deep discounts. The names and full analysis are reserved for our Founding Members.

The 50% Founding Member discount expires on January 21, 2026.

Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute investment advice, financial recommendations, or an offer to buy or sell any securities. Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. Readers should conduct their own research or consult with a licensed financial advisor before making any investment decisions. The views expressed herein are those of the author and do not necessarily reflect the views of any affiliated organizations.