The Industry Just Surrendered

While the "Safe Haven" vaporized $8 trillion, our latest fortress assets generated +14.2%. Here is the math they missed.

“While The Silver Institute reports that industrial use accounts for ~55-60% of demand, this is not a safety net, it is a liability. Industrial producers are incentivized to lower their costs. When prices spike (or China restricts supply), industry doesn’t just pay up; it engineers around the problem.” - Fr. Emmanuel Lemelson

- When the Narrative Breaks - January 4, 2026

On February 5th, the industry surrendered.

The collapse of a market narrative is rarely a mystery to those who prioritize independent judgment over the “Reality by Affirmance” found on terminal screens. It begins when the gap between price and intrinsic value becomes a chasm, a period that can be described as the buildup of “Psychic Wealth,” where the speculator feels rich precisely because he has stopped looking at the balance sheet.

To survive the end of such a “Speculative Mood,” one must possess more than a trend-following algorithm; one must maintain a level of thorough analysis that treats a security as a partial ownership in a real business, not a chip in a high-stakes game of roulette.

“But if the utility of silver is an input cost in manufacturing, the manufacturers aren’t interested in preserving that price. They’re interested in how they can reduce the price… they’re really asking questions how they can be very sparing with the use of silver, possibly even replace it.” - Fr. Emmanuel Lemelson

- Silver Price CRASH INCOMING? Should You Be Worried? - January 3, 2026

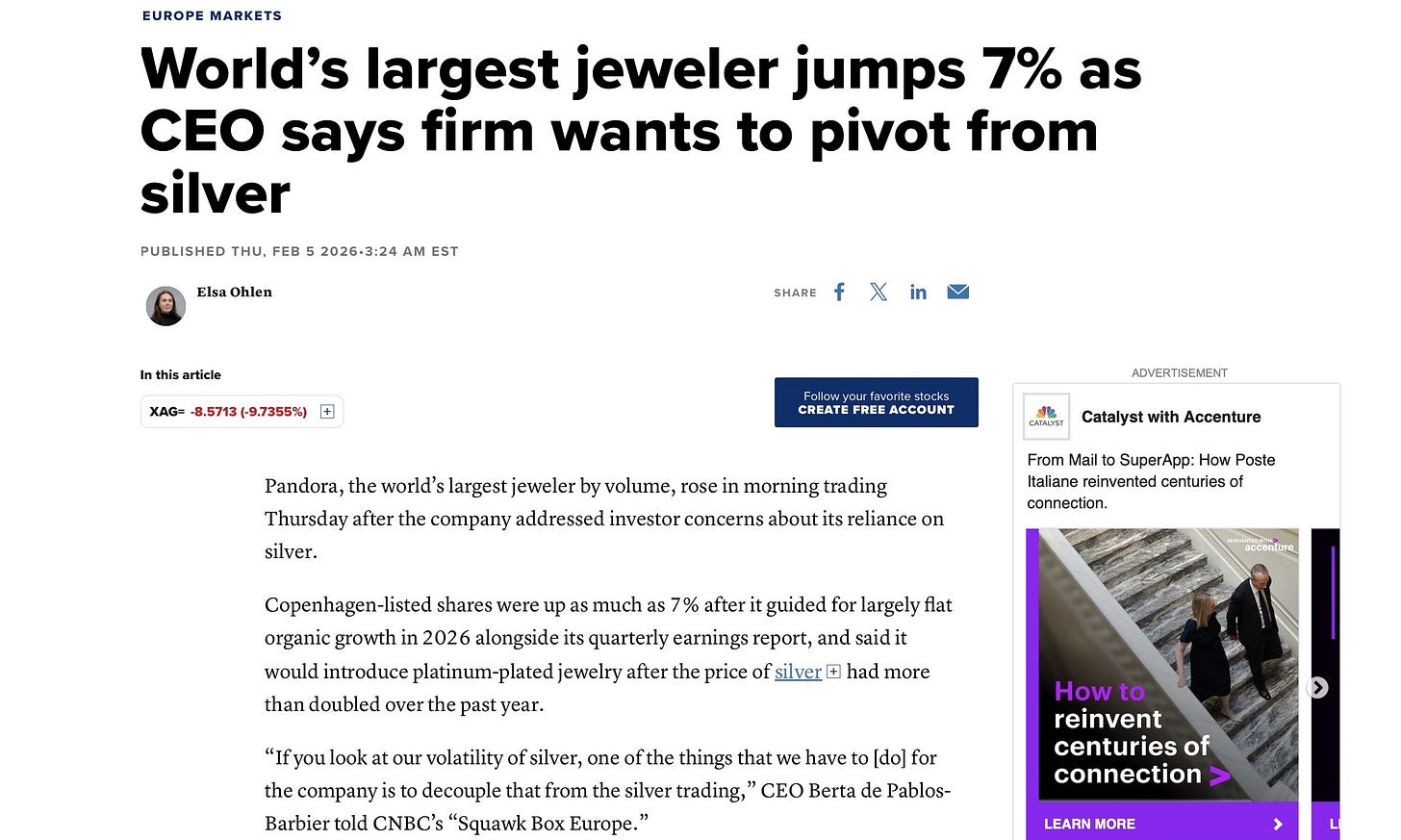

The Pandora Capitulation

The true measure of intelligent investing is found in the behavior of the underlying business, away from the “Dream Market” of the exchanges. For months, our thesis held that the speculative “War Trade” in silver would eventually destroy the metal’s industrial utility.

Last Thursday, February 5th, the world’s largest jeweler, Pandora, confirmed this reality with devastating precision. Faced with a surge in prices that doubled raw material costs, Pandora announced a definitive pivot: abandoning silver in favor of platinum-plated alloys. The scale of this exit cannot be overstated. Silver historically represented nearly one-third of Pandora’s cost of goods sold, making it their single largest production expense. By consuming roughly 340 tons of silver annually (approximately 6% of the global recycled market), Pandora was a pillar of industrial demand. Their strategic target is now to reduce silver’s share in their jewelry assortment from 60% down to just 25% by 2027.

Pandora is not an outlier.

In the language of the “Economic Moat,” silver’s position was breached not by a competitor, but by its own price. The “Prophets” of Wall Street promised silver was a sanctuary, but the “Department of War,” the geopolitical reality of a system that “loots” rather than “loses,” has now closed the table as we wrote on January 10:

When a commodity price alienates its largest consumers, it ceases to be a “Safe Haven” and becomes a liability. Pandora’s departure marks the moment the “Bezzle,” the inventory of mistaken value, was finally liquidated by the real economy.

“How much of that is driven by an incestuous bubble... the digital ouroboros... if that were to decline or pull back or heaven forbid collapse—it would actually be a healthy thing.” - Fr. Emmanuel Lemelson

- Silver Price CRASH INCOMING? Should You Be Worried? - January 3, 2026

The Baseline (January 3, 2026)

The Pandora announcement was the inevitable conclusion of a math problem identified in the first week of the year. To understand the discipline required to remain within one’s “circle of competence” while the herd chases a “bezzle,” one must revisit the roadmap issued before the market was liquidated.

When the realization hits that only 6% of the wealth in the silver market is physically represented, the resulting “Minsky moment” will likely trigger the same regulatory interventions seen in 1980 and 2011: margin hikes and forced cash settlements that will vaporize the retail “hoarder”. - Fr. Emmanuel Lemelson

- The $5,500 Gold Trap: Why the “Safe Haven” is the Ultimate Bezzle - January 29, 2026

This was further quantified on January 29th, less than 24 hours before the historic crash, when we identified the “17-to-1 math problem.” This realization revealed that only 6% of the wealth in the silver market was physically represented. We explicitly predicted that this disparity would lead to the “liquidation of the silver market” through regulatory interventions and margin hikes, effectively eliminating the retail “hoarder” just as Pandora was forced to exit.

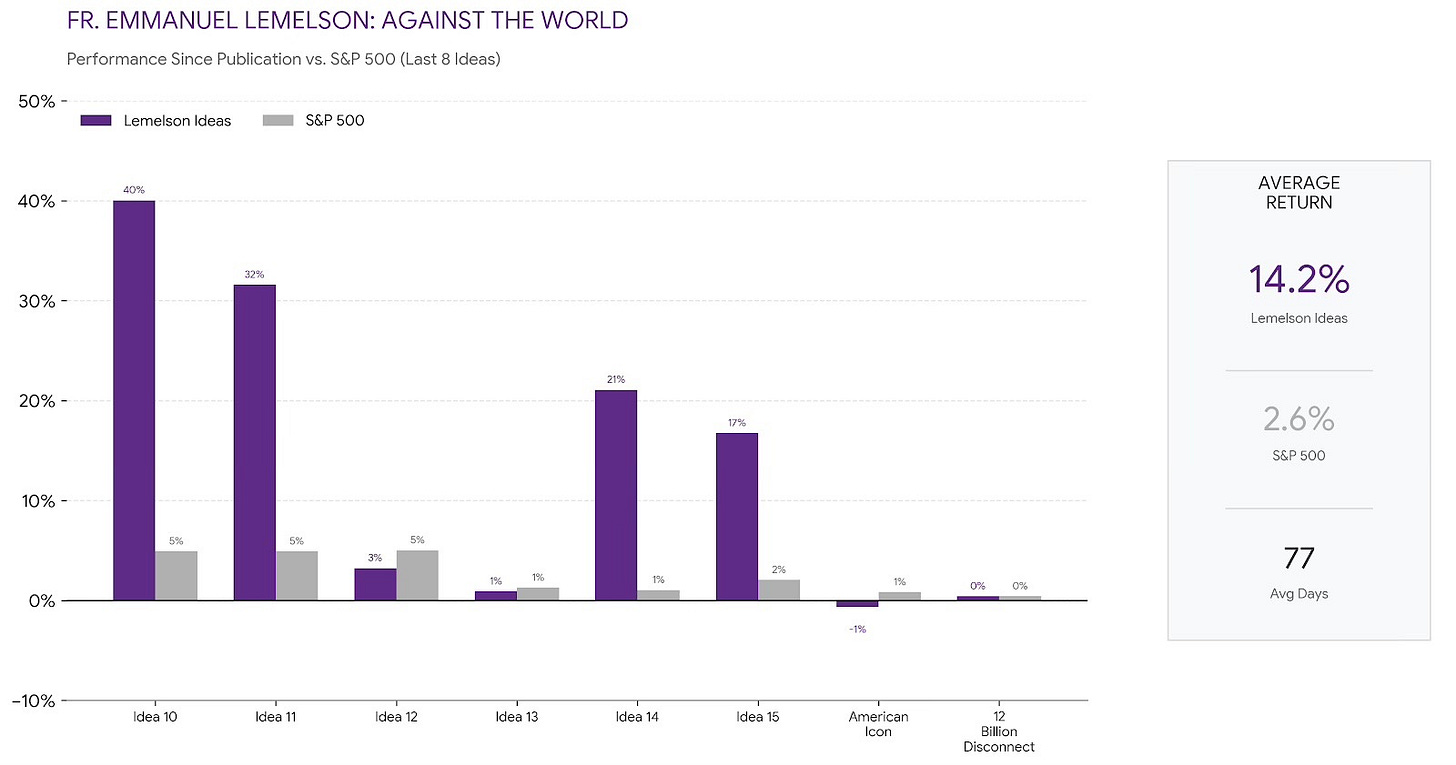

The Evidence of a Disciplined Operation

While the speculative crowd followed the market into a -33% intraday silver crater on January 30 2026, eliminating an estimated 10 trillion in “wealth,” in minutes from the metals market, the application of our principles provided a fortress of uncorrelated alpha. As the great economist Galbraith once noted, “Nothing so gives the illusion of intelligence as personal association with large sums of money,” but the following “Lemelson Ideas” are the result of an actual Margin of Safety:

The Lesson of the Margin of Safety

The difference between a speculator and an investor is a matter of temperament. The speculator seeks safety in what others are buying; the investor seeks a Margin of Safety in what others have abandoned.

The current landscape has yielded a rare openings such as idea 16: The “American Icon” with a 16% yield, currently trading at a price that suggests a state of irrational panic, while idea 17: The “12 Billion Disconnect” has been left for dead. This is the hallmark of the Intelligent Investor, finding the “Fortress” that the crowd has abandoned in their rush for the exits.

The narrative has shattered. The timeline of January’s research predicted it. Pandora’s surrender confirmed it. The operation continues.

The Community

In about 11 weeeks, you have pushed this publication to #55 on the global leaderboard in our category (there are 50,000+ publishers on Substack). Thank You.

Gain immediate access to the full analysis of the “American Icon for ‘Free,’” the “$12 Billion Disconnect,” and the complete archive of the Superinvestor Protocol. Identify the next discrepancy between price and value before a catalyst closes the gap.

*A note on calculating performance

The chart titled “the last 8 ideas” excludes the entire list because some of the previous ideas involve companies that have been acquired.

Idea #1: Walgreens (WBA) was acquired August 28, 2025

(29.23% return vs. the S&P 500’s 6.73%)

Idea #4: Big Five Sporting Goods (BGFV) was acquired October 2, 2025

(49.48% return vs. S&P 500’s 27.19%)

The crystallized returns of these ideas gradually resulted in understated overall returns. Additionally, idea 15, titled “The American Icon,” was re-numbered as idea 16 due to the addition of our December 17, 2025 thesis on Deckers (DECK) to the chart, which was chronologically placed before it.

We will republish the full list (accounting for the acquisitions) in the future.

Investment ideas 16 and 17 were introduced on January 22 and February 4, respectively. Consequently, two out of the eight investment ideas, or 25%, have had only a few days to contribute to the overall performance.

Despite this, achieving a return of over 14 percent (compared to the benchmark’s 2.6%) over an average of 77 days is, in our opinion, better than average performance.

Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute investment advice, financial recommendations, or an offer to buy or sell any securities. Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. Readers should conduct their own research or consult with a licensed financial advisor before making any investment decisions. The views expressed herein are those of the author and do not necessarily reflect the views of any affiliated organizations.