Buying the "Dead" Monopoly: Why the Gate Closes in 5 Days

The Street sees a corpse. I see 114% upside. Plus: The "mathematical glitch" that grants you 7 months free, if you act before Midnight on Jan 20.

The market is a theater of noise. It is a cacophony designed to distract the soul and confiscate your capital. The “Street” screams because it is afraid of silence. It bombards you with chatter, the “daily update,” the “hot take,” the endless churn of the ticker tape, because if you were ever allowed to sit in stillness, you would realize the game is rigged.

I do not publish to feed an algorithm. I publish only when the arithmetic of value and the moral imperative of truth align.

Most analysts sell you lottery tickets. I offer you a fortress.

I. The Protocol of the Dean

The market is a voting machine in the short run, but a weighing machine in the long run. Our task is to ignore the voting, the hysterical fluctuations of price driven by sentiment, and focus entirely on the weighing.

This is the “Superinvestor Protocol” It is not a magic trick; it is the rigorous application of a Margin of Safety. It is the discipline to buy a dollar for fifty cents.

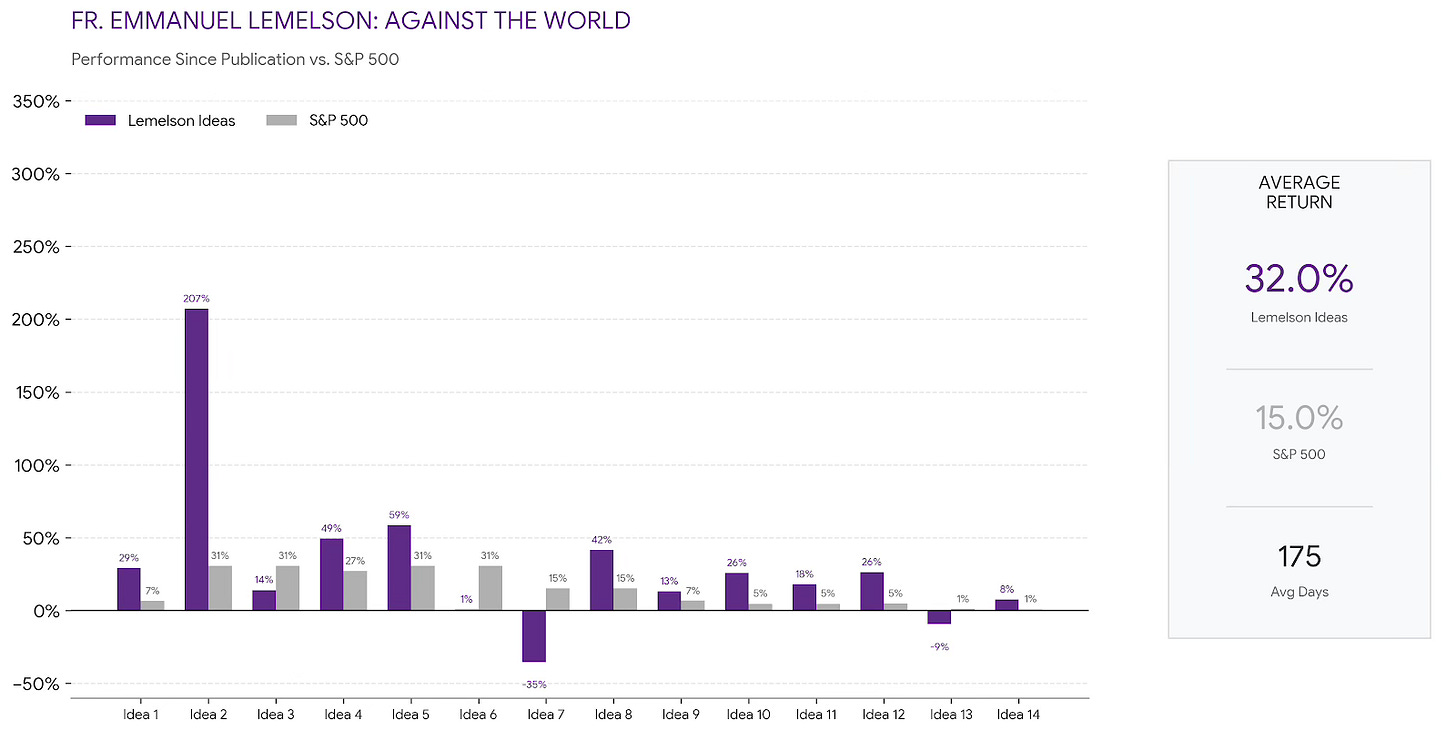

This protocol is the “wiring” that has delivered an average return of +32% on our high-conviction ideas in an average of 175 days, crushing the S&P 500 benchmark (15%) by a wide margin.

It is the same discipline that allowed us to identify “The Cannibal” when it was left for dead, identifying a massive disconnect between its price and its intrinsic value just before it rallied.

And it is this same strict adherence to arithmetic that led us, just this week, to release our analysis on the “Dead Monopoly.”

While the consensus screams “obsolescence” and drives the stock to a 52-week low, our analysis reveals one of the most violent price-value dislocations of the decade. We are not speculating on a turnaround; we are buying a compounder at a distress price, with a clear mathematical path to ~114% upside.

II. The Witness of the Pugilist

Do you think the “Smart Money” wants you to know this? Of course not. They want you terrified. They want you selling at the bottom and buying at the top. They want you to believe the “War Trade” is a sure thing, even as we exposed it as a lie, a mere liquidity grab by an Empire facing a margin call.

We mapped the “Imperial Margin Call” while the rest of the world was distracted by the theatrics in Venezuela.

My edge was not forged in a classroom. It was forged in a war.

For over a decade, I fought the U.S. Government in a battle I called “The North Korea Protocol.” The SEC, the “policemen” of this grotesque casino, targeted me not because I was wrong, but because I was effective.

They tried to break the man because they could not break the thesis. And in their own filings, even as they hunted me, they were forced to admit the truth: I was a “top hedge fund manager”.

You can hunt the Priest, but you cannot kill the Truth.

III. The Call of the Steward

Why do we do this? Because finance is not separate from the soul. The way we steward our resources is a reflection of our inner state.

The Fathers of the Church spoke of Nepsis, watchfulness, sobriety, a vigilant guarding of the heart against the “thoughts” (logismoi) that seek to enslave us. In the spiritual life, these thoughts lead to sin. In the financial life, they lead to ruin.

The “Tower of Babel” we see being built in Greenland, this fantasy of a “Network State,” is a spiritual sickness. It is the hubris of man believing he can ascend to heaven without God.

We must stand apart. We must have the Nepsis to see the “Golden Age of Fraud” for what it is: a spiritual counterfeit.

IV. The Final Accounting

We are building this publication to be a sanctuary for the Truth. But a sanctuary must have walls.

We are freezing the gate for our Founding Members, those of you who understand that Value and Virtues are inseparable.

On January 21, this gate closes.

Because we price our standard access at the institutional rate of $299/month, the current Founding Member lock (~$1,500/year) creates a mathematical anomaly. It is a “glitch” in the matrix of Wall Street pricing:

You pay for 5 months. You get the next 7 months free.

And unlike the fleeting promises of this world, this rate is locked for life. You will never pay the full institutional rate as long as you remain with us.

The year ahead will be volatile. The “Digital Ouroboros” is eating its own tail. You will need a guide who has walked through the fire and refused to burn.

Secure your wiring before the silence ends.

Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute investment advice, financial recommendations, or an offer to buy or sell any securities. Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. Readers should conduct their own research or consult with a licensed financial advisor before making any investment decisions. The views expressed herein are those of the author and do not necessarily reflect the views of any affiliated organizations.

Impressive articulation of how panic creates mispricig opportunitys that disciplined value investors dunno how to exploit. The connection between spiritual watchfulness (Nepsis) and financial discernment is fascinating, especially the idea that stewarding capital is inseparable from stewarding the soul. I run into this alot with portfolio managers who can spot the numbers but totally miss the behavioral patterns driving selloffs that create those 50-cent dollars.